HP 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 4: Balance Sheet Details (Continued)

HP has third-party financing arrangements in order to facilitate the working capital requirements

of certain partners consisting of revolving short-term financing. These financing arrangements, which in

certain circumstances may contain partial recourse, result in a transfer of HP’s receivables and risk to

the third party. As these transfers qualify as true sales, the receivables are derecognized from the

Consolidated Balance Sheets upon transfer, and HP receives a payment for the receivables from the

third party within a mutually agreed upon time period. For arrangements involving an element of

recourse, the recourse obligation is measured using market data from similar transactions and reported

as a current liability in the Consolidated Balance Sheets. The recourse obligation as of October 31,

2012 and 2011 were not material. As of October 31, 2012, the capacity of the partial recourse facility

was $876 million and for arrangements not involving recourse, the total aggregate capacity was

$636 million.

For fiscal 2012 and 2011, trade receivables sold under these facilities were $4.3 billion and

$2.8 billion, respectively, which approximates the amount of cash received. The resulting costs

associated with the sales of trade accounts receivable for the twelve months ended October 31, 2012

and 2011 were not material. HP had $0.8 billion as of October 31, 2012 and $0.7 billion as of

October 31, 2011 of available capacity under these programs.

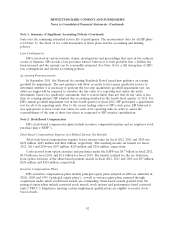

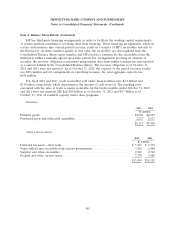

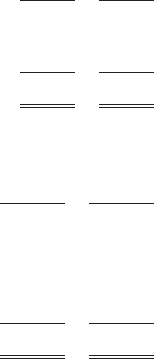

Inventory

2012 2011

In millions

Finished goods .................................................... $4,094 $4,869

Purchased parts and fabricated assemblies ................................ 2,223 2,621

$6,317 $7,490

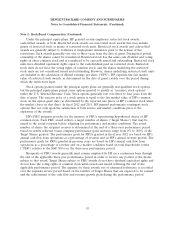

Other Current Assets

2012 2011

In millions

Deferred tax assets—short-term ...................................... $ 3,783 $ 5,374

Value-added taxes receivable from various governments ..................... 3,298 2,480

Supplier and other receivables ....................................... 2,549 2,762

Prepaid and other current assets ..................................... 3,730 3,486

$13,360 $14,102

101