HP 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

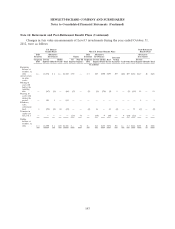

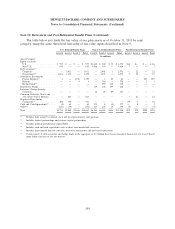

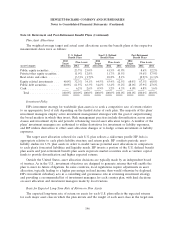

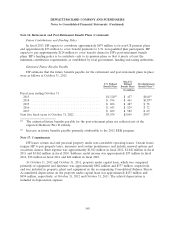

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

Future Contributions and Funding Policy

In fiscal 2013, HP expects to contribute approximately $674 million to its non-US pension plans

and approximately $33 million to cover benefit payments to U.S. non-qualified plan participants. HP

expects to pay approximately $124 million to cover benefit claims for HP’s post-retirement benefit

plans. HP’s funding policy is to contribute cash to its pension plans so that it meets at least the

minimum contribution requirements, as established by local government, funding and taxing authorities.

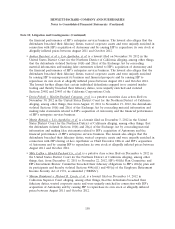

Estimated Future Benefits Payable

HP estimates that the future benefits payable for the retirement and post-retirement plans in place

were as follows at October 31, 2012:

Non-U.S.

U.S. Defined Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans(1)

In millions

Fiscal year ending October 31

2013 ........................................ $1,324(2) $ 437 $164(2)

2014 ........................................ $ 594 $ 461 $133(2)

2015 ........................................ $ 606 $ 487 $ 78

2016 ........................................ $ 643 $ 529 $ 72

2017 ........................................ $ 689 $ 582 $ 69

Next five fiscal years to October 31, 2022 ............... $3,674 $3,645 $307

(1) The estimated future benefits payable for the post-retirement plans are reflected net of the

expected Medicare Part D subsidy.

(2) Increase in future benefits payable primarily attributable to the 2012 EER program.

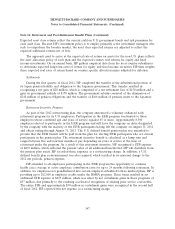

Note 17: Commitments

HP leases certain real and personal property under non-cancelable operating leases. Certain leases

require HP to pay property taxes, insurance and routine maintenance and include renewal options and

escalation clauses. Rent expense was approximately $1,012 million in fiscal 2012, $1,042 million in fiscal

2011 and $1,062 million in fiscal 2010. Sublease rental income was approximately $37 million in fiscal

2012, $38 million in fiscal 2011 and $46 million in fiscal 2010.

At October 31, 2012 and October 31, 2011, property under capital lease, which was comprised

primarily of equipment and furniture, was approximately $882 million and $577 million, respectively,

and was included in property, plant and equipment in the accompanying Consolidated Balance Sheets.

Accumulated depreciation on the property under capital lease was approximately $453 million and

$454 million, respectively, at October 31, 2012 and October 31, 2011. The related depreciation is

included in depreciation expense.

148