Cricket Wireless 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

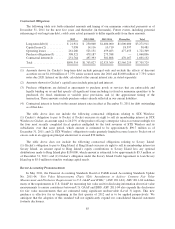

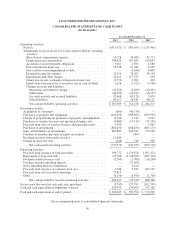

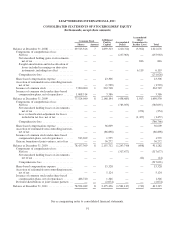

Contractual Obligations

The following table sets forth estimated amounts and timing of our minimum contractual payments as of

December 31, 2011 for the next five years and thereafter (in thousands). Future events, including potential

refinancing of our long-term debt, could cause actual payments to differ significantly from these amounts.

2012 2013-2014 2015-2016 Thereafter Total

Long-term debt(1) ......... $ 21,911 $ 250,000 $1,400,000 $1,600,000 $3,271,911

Capital leases(2) ........... 7,058 14,116 10,710 18,597 50,481

Operating leases ........... 261,260 523,131 459,463 477,455 1,721,309

Purchase obligations(3) ..... 308,321 479,187 273,388 — 1,060,896

Contractual interest(4) ...... 251,764 497,393 381,808 470,167 1,601,132

Total .................... $850,314 $1,763,827 $2,525,369 $2,566,219 $7,705,729

(1) Amounts shown for Cricket’s long-term debt include principal only and exclude the effects of discount

accretion on our $1,100 million of 7.75% senior secured notes due 2016 and $1,600 million of 7.75% senior

notes due 2020. Interest on the debt, calculated at the current interest rate, is stated separately.

(2) Amounts shown for Cricket’s capital leases include principal and interest.

(3) Purchase obligations are defined as agreements to purchase goods or services that are enforceable and

legally binding on us and that specify all significant terms including (a) fixed or minimum quantities to be

purchased, (b) fixed, minimum or variable price provisions, and (c) the approximate timing of the

transaction. These amounts exclude purchase orders already reflected in our current liabilities.

(4) Contractual interest is based on the current interest rates in effect at December 31, 2011 for debt outstanding

as of that date.

The table above does not include the following contractual obligations relating to STX Wireless:

(1) Cricket’s obligation to pay to Pocket, if Pocket exercises its right to sell its membership interest in STX

Wireless to Cricket, an amount equal to 24.25% of the product of Leap’s enterprise value-to-revenue multiple for

the four most recently completed fiscal quarters multiplied by the total revenues of STX Wireless and its

subsidiaries over that same period, which amount is estimated to be approximately $90.7 million as of

December 31, 2011; and (2) STX Wireless’ obligation to make quarterly limited-recourse loans to Pocket out of

excess cash in an aggregate principal amount not to exceed $30 million.

The table above does not include the following contractual obligations relating to Savary Island:

(1) Cricket’s obligation to pay to Ring Island, if Ring Island exercises its right to sell its membership interest in

Savary Island, an amount equal to Ring Island’s equity contributions to Savary Island less any optional

distributions made to Ring Island plus $150,000, which amount is estimated to be approximately $5.3 million as

of December 31, 2011; and (2) Cricket’s obligation under the Savary Island Credit Agreement to loan Savary

Island up to $5.0 million to fund its working capital needs.

Recent Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board or FASB issued Accounting Standards Update

No. 2011-04, “Fair Value Measurements (Topic 820): Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs,” (ASU 2011-04). ASU 2011-04 redefines

many of the requirements in U.S. GAAP for measuring fair value and for disclosing information about fair value

measurements to ensure consistency between U.S. GAAP and IFRS. ASU 2011-04 also expands the disclosures

for fair value measurements that are estimated using significant unobservable (Level 3) inputs. This new

guidance is effective for us beginning in the first quarter of 2012 and is to be applied prospectively. We

anticipate that the adoption of this standard will not significantly expand our consolidated financial statement

footnote disclosures.

85