Cricket Wireless 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

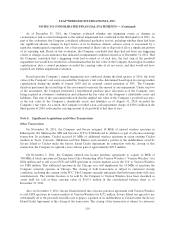

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

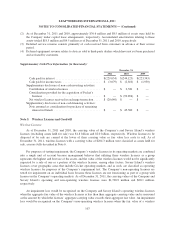

Basic and Diluted Earnings (Loss) Per Share

Basic earnings (loss) per share is computed by dividing net income (loss) available to common stockholders

by the weighted-average number of common shares outstanding during the period. Diluted earnings per share is

computed by dividing net income available to common stockholders by the sum of the weighted-average number

of common shares outstanding during the period and the weighted-average number of dilutive common share

equivalents outstanding during the period, using the treasury stock method and the if-converted method, where

applicable. Dilutive common share equivalents are comprised of stock options, restricted stock awards, employee

stock purchase rights and convertible senior notes. Since the Company incurred losses for the years ended

December 31, 2011, 2010 and 2009, 7.8 million, 9.4 million and 9.3 million common share equivalents were

excluded in the computation of diluted loss per share for those periods, respectively.

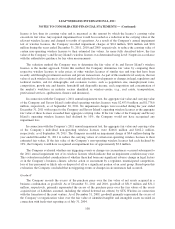

Recent Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

No. 2011-04, “Fair Value Measurements (Topic 820): Amendments to Achieve Common Fair Value

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs,” (“ASU 2011-04”). ASU 2011-04

redefines many of the requirements in U.S. GAAP for measuring fair value and for disclosing information about

fair value measurements to ensure consistency between U.S. GAAP and IFRS. ASU 2011-04 also expands the

disclosures for fair value measurements that are estimated using significant unobservable (Level 3) inputs. This

new guidance is effective for the Company beginning in the first quarter of 2012 and is to be applied

prospectively. The Company anticipates that the adoption of this standard will not significantly expand its

consolidated financial statement footnote disclosures.

In June 2011, the FASB issued Accounting Standards Update No. 2011-05, “Comprehensive Income

(Topic 220): Presentation of Comprehensive Income,” (“ASU 2011-05”). ASU 2011-05 eliminates the option to

report other comprehensive income and its components in the statement of changes in equity. ASU 2011-05

requires that all nonowner changes in stockholders’ equity be presented in either a single continuous statement of

comprehensive income or in two separate but consecutive statements. This new guidance is effective for the

Company beginning in the first quarter of 2012 and is to be applied retrospectively.

In September 2011, the FASB issued Accounting Standards Update No. 2011-08, “Goodwill Impairment

Testing,” (“ASU 2011-08”). ASU 2011-08 simplifies the requirements for testing for goodwill impairment and

permits an entity to first assess qualitative factors to determine whether it is more likely than not that the fair

value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to

perform the two-step goodwill impairment test as described in the authoritative guidance for goodwill. This new

guidance is effective for the Company beginning in the first quarter of 2012 and will be applied prospectively.

The Company anticipates that the adoption of this standard will not materially impact the Company or its

consolidated financial statement footnote disclosures.

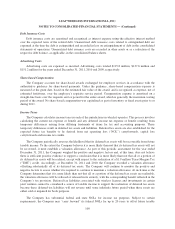

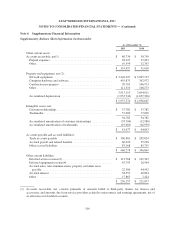

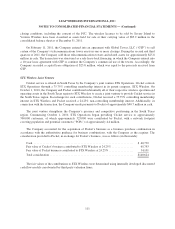

Note 3. Fair Value of Financial Instruments and Non-Financial Assets

Fair Value of Financial Instruments

The authoritative guidance for fair value measurements defines fair value for accounting purposes,

establishes a framework for measuring fair value and provides disclosure requirements regarding fair value

measurements. The guidance defines fair value as an exit price, which is the price that would be received upon

the sale of an asset or paid upon the transfer of a liability in an orderly transaction between market participants at

the measurement date. The degree of judgment utilized in measuring the fair value of assets and liabilities

generally correlates to the level of pricing observability. Assets and liabilities with readily available, actively

102