Cricket Wireless 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

The consideration was allocated to the tangible and intangible assets acquired and liabilities assumed by

STX Wireless based on their fair values as of October 1, 2010. The excess of the purchase price over the fair

values of the net assets acquired was recorded as goodwill.

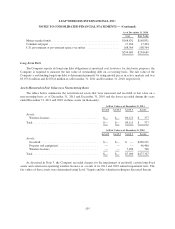

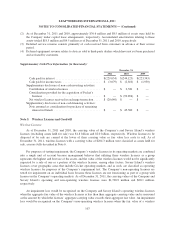

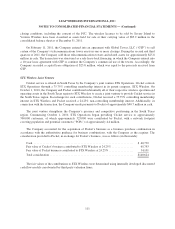

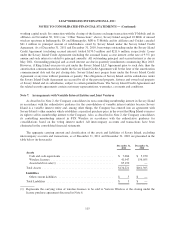

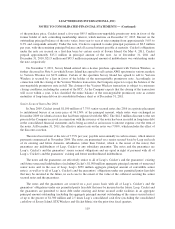

The following amounts represent the fair value of identifiable assets acquired and liabilities assumed by the

Company (in thousands):

Fair Value

Assets:

Inventories ............................................................. $ 2,331

Other current assets ...................................................... 845

Property and equipment ................................................... 41,971

Wireless licenses ........................................................ 33,716

Customer relationships .................................................... 50,435

Goodwill ............................................................... 31,326

Total Assets ............................................................ 160,624

Liabilities:

Accounts payable and accrued liabilities ...................................... $ 3,752

Deferred revenue ........................................................ 4,365

Deferred tax liability ..................................................... 10,693

Other long-term liabilities ................................................. 1,190

Total liabilities .......................................................... 20,000

Total net assets acquired .................................................... $140,624

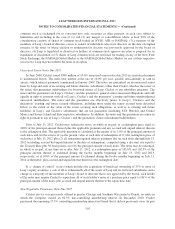

Goodwill primarily represents the future economic benefits arising from other assets acquired that could not

be individually identified and separately recognized. The goodwill arising from the transaction consisted largely

of the synergies expected from the joint venture. As part of the valuation, the Company recorded approximately

$50.4 million of finite-lived intangible assets, representing the fair value of customer relationships, which are

amortized on an accelerated basis over an estimated useful life of four years. Additionally, the Company

recorded approximately $33.7 million of wireless licenses acquired in the transaction. Consistent with the

Company’s policy regarding the useful lives of its wireless licenses, the wireless licenses acquired have an

indefinite useful life.

The Company has not presented pro forma financial information reflecting the effects of the transaction

because such effects are not material.

During the year ended December 31, 2010, a gain of $48.4 million arose from the formation of the joint

venture transaction, representing Cricket’s proportionate interest (75.75%) in the fair value of the Pocket

business acquired by STX Wireless less the proportionate interest (24.25%) in the book value of Cricket’s South

Texas business contributed by Cricket to the venture, and cash payments made by Cricket to Pocket of $40.7

million. Because the Company maintained control over the joint venture after its formation, the gain was

recognized in additional paid-in capital within stockholders’ equity.

Pocket’s 24.25% non-controlling membership interest in STX Wireless was recorded in mezzanine equity as

a component of redeemable non-controlling interests. The non-controlling interest was initially recognized as

part of the purchase accounting in the amount of $51.5 million. The $51.5 million amount comprised the sum of

Pocket’s proportionate share (24.25%) of the fair value in the business contributed to the joint venture by Pocket

plus its proportionate share (24.25%) of the net equity of the business contributed by Cricket.

112