Cricket Wireless 2011 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

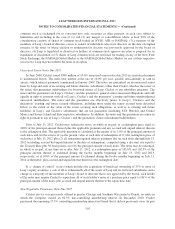

The joint venture is controlled and managed by Cricket under the terms of the amended and restated limited

liability company agreement (the “STX LLC Agreement”). Under the STX LLC Agreement, Pocket has the right

to put, and the Company has the right to call, all of Pocket’s membership interests in STX Wireless, which rights

are generally exercisable on or after April 1, 2014. In addition, in the event of a change of control of Leap,

Pocket is obligated to sell to the Company all of its membership interests in STX Wireless. The purchase price

for Pocket’s membership interests would be equal to 24.25% of the product of Leap’s enterprise value-to-revenue

multiple for the four most recently completed fiscal quarters multiplied by the total revenues of STX Wireless

and its subsidiaries over that same period. The purchase price is payable in either cash, Leap common stock or a

combination thereof, as determined by Cricket in its discretion (provided that, if permitted by Cricket’s debt

instruments, at least $25 million of the purchase price must be paid in cash). The Company has the right to

deduct from or set off against the purchase price certain distributions made to Pocket, as well as any obligations

owed to the Company by Pocket. Under the STX LLC Agreement, Cricket is permitted to purchase Pocket’s

membership interests in STX Wireless over multiple closings in the event that the block of shares of Leap

common stock issuable to Pocket at the closing of the purchase would be greater than 9.9% of the total number of

shares of Leap common stock then issued and outstanding. To the extent the redemption price for Pocket’s

non-controlling membership interest varies from the value of Pocket’s net interest in STX Wireless at any period

(after the attribution of profits or losses), the value of such interest is accreted to the redemption price for such

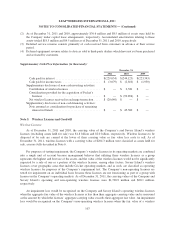

interest with a corresponding adjustment to additional paid-in capital. For the years ended December 31, 2011

and 2010, the Company recorded a net accretion benefit of $8.9 million and accretion charges of $48.1 million,

respectively, to bring the carrying value of Pocket’s membership interests in STX Wireless to its estimated

redemption values of $90.7 million and $99.5 million, respectively. Additionally, and in accordance with the

STX LLC Agreement, STX Wireless made pro-rata distributions of $5.7 million and $1.7 million to Cricket and

Pocket, respectively, with respect to their estimated tax liabilities resulting from STX Wireless’ earnings for the

year ended December 31, 2011. The Company recorded the distribution to Pocket as an adjustment to additional

paid-in-capital in the consolidated balance sheets and as a component of accretion of redeemable non-controlling

interests and distributions, net of tax, in the consolidated statements of operations. The distribution made to

Cricket was eliminated in consolidation.

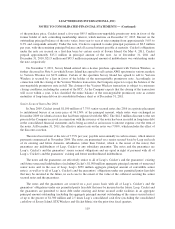

At the closing of the formation of the joint venture, STX Wireless entered into a loan and security

agreement with Pocket pursuant to which, commencing in April 2012, STX Wireless agreed to make quarterly

limited-recourse loans to Pocket out of excess cash in an aggregate principal amount not to exceed $30 million,

which loans are secured by Pocket’s membership interests in STX Wireless. Such loans will bear interest at

8.0% per annum, compounded annually, and will mature on the earlier of October 2020 and the date on which

Pocket ceases to hold any membership interests in STX Wireless. Cricket has the right to set off all outstanding

principal and interest under this loan and security agreement against the payment of the purchase price for

Pocket’s membership interests in STX Wireless in the event of a put, call or mandatory buyout following a

change of control of Leap.

In a separate transaction, on January 3, 2011, the Company acquired Pocket’s customer assistance call

center for $850,000. The Company accounted for this transaction as a business purchase combination in

accordance with the authoritative guidance for business combinations. A portion of the purchase price was

assigned to property and equipment and the remaining amount was allocated to goodwill.

During 2011, the Company completed the integration of the Cricket and Pocket operating assets in the South

Texas region so that the combined network and retail operations of the STX Wireless joint venture operate more

efficiently. During the year ended December 31, 2011, the Company incurred approximately $26.4 million of

integration charges relating primarily to certain leased cell site and retail store locations contributed to STX

Wireless that it no longer uses, which were recorded in impairments and other charges within the Company’s

consolidated statements of operations. As of December 31, 2011, integration activities were substantially

complete and the Company does not expect to incur additional significant integration costs.

113