Cricket Wireless 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investing Activities

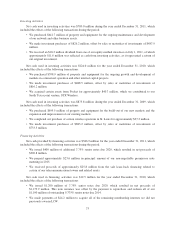

Net cash used in investing activities was $780.0 million during the year ended December 31, 2011, which

included the effects of the following transactions during the period:

• We purchased $441.7 million of property and equipment for the ongoing maintenance and development

of our network and other business assets.

• We made investment purchases of $826.2 million, offset by sales or maturities of investments of $487.9

million.

• We received an $18.2 million dividend from one of our equity method investees on July 1, 2011, of which

approximately $11.6 million was reflected as cash from investing activities, as it represented a return of

our original investment.

Net cash used in investing activities was $124.0 million for the year ended December 31, 2010, which

included the effects of the following transactions:

• We purchased $398.9 million of property and equipment for the ongoing growth and development of

markets in commercial operation and other internal capital projects.

• We made investment purchases of $488.5 million, offset by sales or maturities of investments of

$816.2 million.

• We acquired certain assets from Pocket for approximately $40.7 million, which we contributed to our

South Texas joint venture, STX Wireless.

Net cash used in investing activities was $875.8 million during the year ended December 31, 2009, which

included the effects of the following transactions:

• We purchased $699.5 million of property and equipment for the build-out of our new markets and the

expansion and improvement of our existing markets.

• We completed our purchase of certain wireless spectrum in St. Louis for approximately $27.2 million.

• We made investment purchases of $883.2 million, offset by sales or maturities of investments of

$733.3 million.

Financing Activities

Net cash provided by financing activities was $386.9 million for the year ended December 31, 2011, which

included the effects of the following transactions during the period:

• We issued $400 million of additional 7.75% senior notes due 2020, which resulted in net proceeds of

$396.8 million.

• We prepaid approximately $23.6 million in principal amount of our non-negotiable promissory note

maturing in 2015.

• We received proceeds of approximately $25.8 million from the sale lease-back financing related to

certain of our telecommunications towers and related assets.

Net cash used in financing activities was $12.5 million for the year ended December 31, 2010, which

included the effects of the following transactions:

• We issued $1,200 million of 7.75% senior notes due 2020, which resulted in net proceeds of

$1,179.9 million. This note issuance was offset by the payment to repurchase and redeem all of our

$1,100 million of outstanding 9.375% senior notes due 2014.

• We made payments of $24.2 million to acquire all of the remaining membership interests we did not

previously own in LCW.

73