Cricket Wireless 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

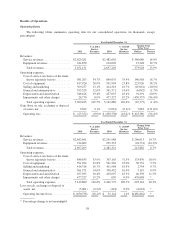

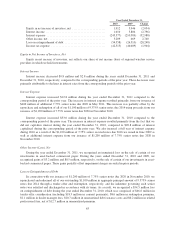

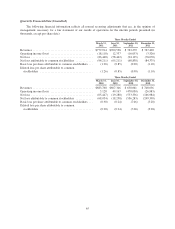

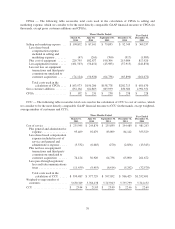

Quarterly Results of Operations Data (Unaudited)

The following table presents our unaudited condensed consolidated quarterly statement of operations data

for 2011, which has been derived from our unaudited condensed consolidated financial statements (in thousands):

Three Months Ended

March 31,

2011

June 30,

2011

September 30,

2011

December 31,

2011

Revenues:

Service revenues ................................. $678,411 $704,087 $717,296 $729,487

Equipment revenues .............................. 101,503 56,451 45,983 37,913

Total revenues ................................. 779,914 760,538 763,279 767,400

Operating expenses:

Cost of service (exclusive of items shown separately

below) ....................................... 235,945 244,870 255,899 244,489

Cost of equipment ................................ 229,795 182,677 190,364 215,084

Selling and marketing ............................. 109,852 87,161 79,895 92,349

General and administrative ......................... 95,409 92,079 83,899 84,142

Depreciation and amortization ...................... 126,674 136,137 144,904 140,711

Impairments and other charges ...................... — 631 23,693 2,446

Total operating expenses ......................... 797,675 743,555 778,654 779,221

Gain (loss) on sale, exchange or disposal of assets, net ..... (349) (4,646) (678) 8,295

Operating income (loss) ........................... (18,110) 12,337 (16,053) (3,526)

Equity in net income of investees, net .................. 1,179 1,010 764 31

Interest income .................................... 64 59 59 63

Interest expense .................................... (58,819) (61,923) (67,028) (68,405)

Other income (loss), net ............................. — (32) 32 (2)

Loss before income taxes .......................... (75,686) (48,549) (82,226) (71,839)

Income tax expense ................................. (10,754) (9,893) (11,899) (6,831)

Net loss ........................................ (86,440) (58,442) (94,125) (78,670)

Accretion of redeemable non-controlling interests, net of

tax ............................................ (9,771) (6,769) 25,295 (5,705)

Net loss attributable to common stockholders .......... $(96,211) $ (65,211) $ (68,830) $ (84,375)

Performance Measures

In managing our business and assessing our financial performance, management supplements the

information provided by financial statement measures with several customer-focused performance metrics that

are widely used in the telecommunications industry. These metrics include ARPU, which measures average

service revenue per customer; CPGA, which measures the average cost of acquiring a new customer; cash costs

per user per month, or CCU, which measures the non-selling cash cost of operating our business on a per

customer basis; churn, which measures turnover in our customer base; and adjusted OIBDA, which measures

operating performance. ARPU, CPGA, CCU and adjusted OIBDA are non-GAAP financial measures. A

non-GAAP financial measure, within the meaning of Item 10 of Regulation S-K promulgated by the SEC, is a

numerical measure of a company’s financial performance or cash flows that (a) excludes amounts, or is subject to

adjustments that have the effect of excluding amounts, which are included in the most directly comparable

measure calculated and presented in accordance with generally accepted accounting principles in the

consolidated balance sheets, consolidated statements of operations or consolidated statements of cash flows; or

(b) includes amounts, or is subject to adjustments that have the effect of including amounts, which are excluded

66