Cricket Wireless 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

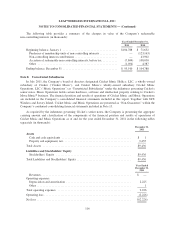

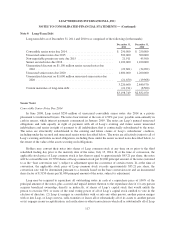

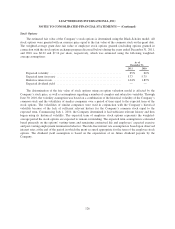

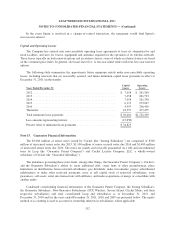

A reconciliation of the amounts computed by applying the statutory federal income tax rate to income

before income taxes to the amounts recorded in the consolidated statements of operations is summarized as

follows (in thousands):

December 31,

2011 2010 2009

Amounts computed at statutory federal rate ................ $(97,405) $(259,890) $ (69,073)

Non-deductible expenses .............................. 376 505 678

State income tax expense, net of federal income tax impact . . . 5,708 6,019 3,218

Net tax expense (benefit) related to ventures ............... (2,856) 18,352 1,384

Non-deductible share-based compensation ................ 6,623 4,505 3,456

Non-deductible goodwill impairment ..................... — 125,164 —

Other .............................................. (2,936) — —

Change in valuation allowance .......................... 129,867 147,858 100,946

$ 39,377 $ 42,513 $ 40,609

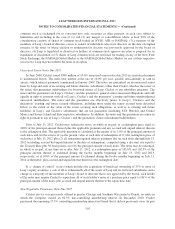

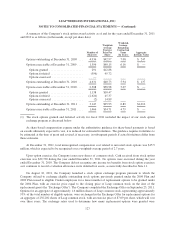

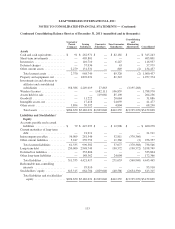

The components of the Company’s deferred tax assets (liabilities) are summarized as follows (in thousands):

As of December 31,

2011 2010

Deferred tax assets:

Net operating loss carryforwards ............................... $ 973,560 $ 794,601

Wireless licenses ............................................ 21,046 26,750

Capital loss carryforwards .................................... 3,031 3,045

Reserves and allowances ...................................... 8,818 12,329

Share-based compensation .................................... 34,631 38,086

Deferred charges ............................................ 53,835 46,329

Investments and deferred tax on unrealized losses .................. 5,478 —

Intangible assets ............................................ 18,545 10,982

Goodwill .................................................. 30,869 43,792

Other ..................................................... 2,328 5,317

Gross deferred tax assets ........................................ 1,152,141 981,231

Deferred tax liabilities:

Property and equipment ...................................... (302,373) (265,737)

Other ..................................................... (439) (5,032)

Net deferred tax assets ......................................... 849,329 710,462

Valuation allowance ........................................... (847,399) (708,479)

Other deferred tax liabilities:

Wireless licenses ............................................ (317,682) (279,327)

Investment in joint ventures ................................... (10,236) (10,608)

Net deferred tax liabilities ....................................... $ (325,988) $(287,952)

123