Cricket Wireless 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

costs for certain network design, site acquisition and capitalized interest relating to the expansion of its network

which has been previously accumulated in construction-in-progress were determined to be impaired and the

Company recorded an impairment charge of $46.5 million during the third quarter of 2010.

Impairment of Indefinite-Lived Intangible Assets

The Company assesses potential impairments to its indefinite-lived intangible assets, including wireless

licenses and goodwill, on an annual basis or when there is evidence that events or changes in circumstances

indicate an impairment condition may exist. In addition on a quarterly basis, the Company evaluates the

triggering event criteria outlined in the authoritative guidance for goodwill and other intangible assets to

determine whether events or changes in circumstances indicate that an impairment condition may exist. The

Company’s annual impairment test is conducted each year during the third quarter as further discussed in Note 5.

Wireless Licenses

The Company operates networks under Personal Communications Services (“PCS”) and Advanced Wireless

Services (“AWS”) wireless licenses granted by the FCC that are specific to a particular geographic area on

spectrum that has been allocated by the FCC for such services. Wireless licenses are recorded at cost when

acquired and are not amortized. Although FCC licenses are issued with a stated term (ten years in the case of

PCS licenses and fifteen years in the case of AWS licenses), wireless licenses are considered to be indefinite-

lived intangible assets because the Company expects to provide wireless service using the relevant licenses for

the foreseeable future, PCS and AWS licenses are routinely renewed for either no or a nominal fee and

management has determined that no legal, regulatory, contractual, competitive, economic or other factors

currently exist that limit the useful lives of the Company’s or Savary Island’s PCS and AWS licenses. On a

quarterly basis, the Company evaluates the remaining useful lives of its indefinite-lived wireless licenses to

determine whether events and circumstances, such as legal, regulatory, contractual, competitive, economic or

other factors, continue to support an indefinite useful life. If a wireless license is subsequently determined to

have a finite useful life, the Company would first test the wireless license for impairment and the wireless license

would then be amortized prospectively over its estimated remaining useful life. In addition, on a quarterly basis,

the Company evaluates the triggering event criteria outlined in the authoritative guidance for the impairment or

disposal of long-lived assets to determine whether events or changes in circumstances indicate that an

impairment condition may exist. The Company also tests its wireless licenses for impairment on an annual basis

in accordance with the authoritative guidance for goodwill and other intangible assets. The Company’s annual

impairment test is conducted each year during the third quarter. Refer to Note 5 for further discussion regarding

the Company’s impairment evaluation of wireless licenses.

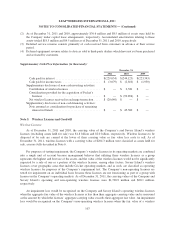

Goodwill

The Company records the excess of the purchase price over the fair value of net assets acquired in a

business combination as goodwill. As of December 31, 2011 and 2010, goodwill of $31.9 million and $31.1

million, respectively, primarily represented the excess of the purchase price over the fair values of the assets

acquired (net of liabilities assumed, including the related deferred tax effects) by STX Wireless in connection

with the formation of the joint venture. Refer to Note 6 for further discussion of the Company’s purchase price

allocation and determination of goodwill. Goodwill is tested for impairment annually as well as when an event or

change in circumstance indicates an impairment may have occurred. The Company’s annual impairment test is

conducted each year during the third quarter. In addition, on a quarterly basis, the Company evaluates the

triggering event criteria outlined in the authoritative guidance for the impairment or disposal of long-lived assets

to determine whether events or changes in circumstances indicate that an impairment condition may exist. Refer

to Note 5 for further discussion regarding the Company’s goodwill impairment evaluation.

97