Cricket Wireless 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

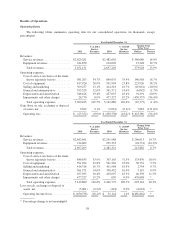

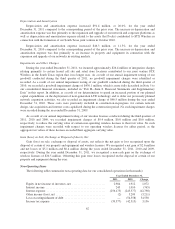

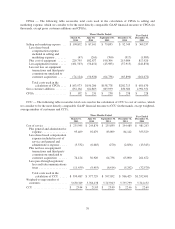

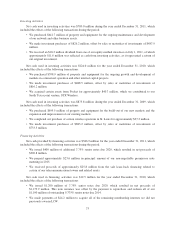

Year Ended December 31,

2010 2009 Change

Equity in net income of investees, net ....................... 1,912 3,946 (2,034)

Interest income ......................................... 1,010 3,806 (2,796)

Interest expense ........................................ (243,377) (210,389) (32,988)

Other income, net ....................................... 3,209 469 2,740

Loss on extinguishment of debt ............................ (54,558) (26,310) (28,248)

Income tax expense ..................................... (42,513) (40,609) (1,904)

Equity in Net Income of Investees, Net

Equity in net income of investees, net reflects our share of net income (loss) of regional wireless service

providers in which we hold investments.

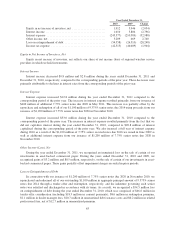

Interest Income

Interest income decreased $0.8 million and $2.8 million during the years ended December 31, 2011 and

December 31, 2010, respectively, compared to the corresponding periods of the prior year. These decreases were

primarily attributable to declines in interest rates from the corresponding periods of the prior year.

Interest Expense

Interest expense increased $12.8 million during the year ended December 31, 2011 compared to the

corresponding period of the prior year. The increase in interest expense resulted primarily from our issuance of

$400 million of additional 7.75% senior notes due 2020 in May 2011. This increase was partially offset by the

repurchase and redemption of all of our $1,100 million of 9.375% senior notes due 2014 using proceeds from our

issuance of $1,200 million of 7.75% senior notes due 2020 in November 2010.

Interest expense increased $33.0 million during the year ended December 31, 2010 compared to the

corresponding period of the prior year. The increase in interest expense resulted primarily from the fact that we

did not capitalize interest during the year ended December 31, 2010, compared to $20.8 million of interest

capitalized during the corresponding period of the prior year. We also incurred a full year of interest expense

during 2010 as a result of the $1,100 million of 7.75% senior secured notes due 2016 we issued in June 2009 as

well as additional interest expense from our issuance of $1,200 million of 7.75% senior notes due 2020 in

November 2010.

Other Income (Loss), Net

During the year ended December 31, 2011, we recognized an immaterial loss on the sale of certain of our

investments in asset-backed commercial paper. During the years ended December 31, 2010 and 2009, we

recognized gains of $3.2 million and $0.5 million, respectively, on the sale of certain of our investments in asset-

backed commercial paper. These gains partially offset impairment charges recorded in prior periods.

Loss on Extinguishment of Debt

In connection with our issuance of $1,200 million of 7.75% senior notes due 2020 in November 2010, we

repurchased and redeemed all of our outstanding $1,100 million in aggregate principal amount of 9.375% senior

notes due 2014 through a tender offer and redemption, respectively, and the indenture governing such senior

notes was satisfied and discharged in accordance with its terms. As a result, we recognized a $54.5 million loss

on extinguishment of debt during the year ended December 31, 2010, which was comprised of $46.6 million in

tender offer consideration (including $18.3 million in consent payments), $8.6 million in redemption premium,

$1.1 million in dealer manager fees, $10.7 million in unamortized debt issuance costs and $0.2 million in related

professional fees, net of $12.7 million in unamortized premium.

63