Cricket Wireless 2011 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

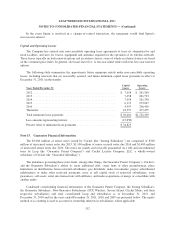

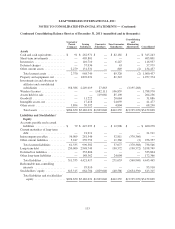

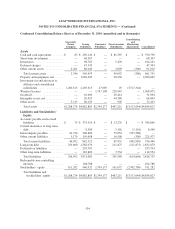

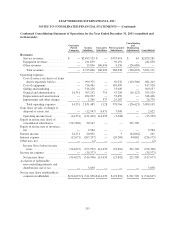

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Other Litigation, Claims and Disputes

In addition to the matters described above, the Company is often involved in certain other matters which

generally arise in the ordinary course of business and which seek monetary damages and other relief. Based upon

information currently available to the Company, none of these other matters is expected to have a material

adverse effect on the Company’s business, financial condition or results of operations.

Indemnification Agreements

From time to time, the Company enters into indemnification agreements with certain parties in the ordinary

course of business, including agreements with manufacturers, licensors and suppliers who provide it with

equipment, software and technology that it uses in its business, as well as with purchasers of assets, lenders,

lessors and other vendors. Indemnification agreements are generally entered into in commercial and other

transactions in an attempt to allocate potential risk of loss.

Wholesale Agreement

In August 2010, the Company entered into a wholesale agreement with an affiliate of Sprint Nextel which

the Company uses to offer Cricket services in nationwide retailers outside of the Company’s current network

footprint. The Company and Sprint amended the agreement in July 2011 to, among other things, revise the

amount of the annual minimum revenue commitments for the years 2011 and 2013.

The initial term of the wholesale agreement runs until December 31, 2015, and automatically renews for

successive one-year periods unless either party provides 180-day advance notice to the other. Under the

agreement, the Company will pay Sprint a specified amount per month for each subscriber activated on its

network, subject to periodic market-based adjustments. The Company has agreed to provide Sprint with a

minimum of $300 million of revenue under the agreement, as amended, over the initial five-year term (against

which the Company can credit up to $100 million of service revenue under other existing commercial

arrangements between the companies), with a minimum of $20 million of revenue to be provided in 2011, a

minimum of $75 million of revenue to be provided in 2012, a minimum of $80 million of revenue to be provided

in 2013, a minimum of $75 million of revenue to be provided in 2014 and a minimum of $50 million of revenue

to be provided in 2015. Any revenue provided by the Company in a given year above the minimum revenue

commitment for that particular year will be credited to the next succeeding year. However, to the extent the

Company’s revenues were to fall beneath the applicable commitment amount for any given year, excess revenues

from a subsequent year could not be carried back to offset such shortfall. In 2011, the Company utilized services

from Sprint at levels which substantially satisfied the Company’s $20 million minimum revenue commitment.

In addition, in the event Leap is involved in a change-of-control transaction with another facilities-based wireless

carrier with annual revenues of at least $500 million in the fiscal year preceding the date of the change of control

agreement (other than MetroPCS Communications, Inc. (“MetroPCS”)), either the Company (or the Company’s

successor in interest) or Sprint may terminate the wholesale agreement within 60 days following the closing of such a

transaction. In connection with any such termination, the Company (or its successor in interest) would be required to

pay to Sprint a specified percentage of the remaining aggregate minimum revenue commitment, with the percentage to

be paid depending on the year in which the change of control agreement was entered into, beginning at 40% for any

such agreement entered into in 2011, 30% for any such agreement entered into in 2012, 20% for any such agreement

entered into in 2013 and 10% for any such agreement entered into in 2014 or 2015.

In the event that Leap is involved in a change-of-control transaction with MetroPCS during the term of the

wholesale agreement, then the agreement would continue in full force and effect, subject to certain revisions,

including, without limitation, an increase to the total minimum revenue commitment to $350 million, taking into

account any revenue contributed by Cricket prior to the date thereof.

131