Cricket Wireless 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

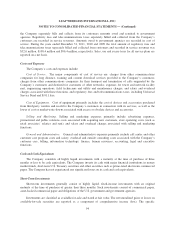

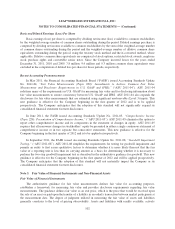

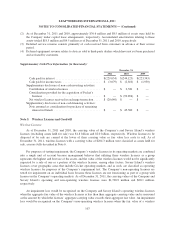

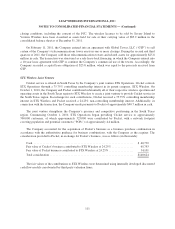

At Fair Value as of December 31, 2010

Level 1 Level 2 Level 3 Total

Assets:

Money market funds ........................... $— $168,831 $— $168,831

Commercial paper ............................. — 17,494 — 17,494

U.S. government or government agency securities .... — 108,364 — 108,364

Total .......................................... $— $294,689 $— $294,689

Assets in the tables above are reported on the consolidated balance sheets as components of cash and cash

equivalents, short-term investments, other current assets and other assets.

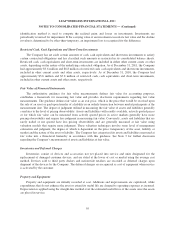

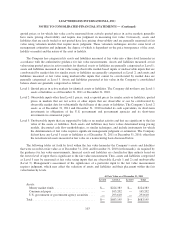

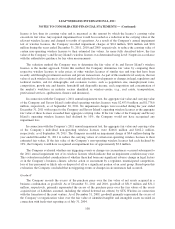

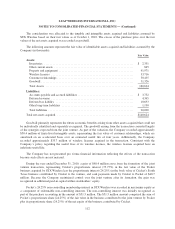

The following table provides a summary of the changes in the fair value of the Company’s Level 3 financial

assets (in thousands).

Year Ended

December 31,

2011 2010

Beginning balance, January 1 .......................................... $ — $2,731

Total gains (losses):

Included in net loss ................................................ $ — $3,341

Included in comprehensive income (loss) .............................. — (1,680)

Purchases and (sales):

Sales ........................................................... — (4,392)

Transfers in (out) of Level 3 ......................................... — —

Ending balance, December 31, ......................................... $ — $ —

Unrealized gains (losses) are presented in accumulated other comprehensive loss within stockholders’

equity in the consolidated balance sheets. Realized gains (losses) are presented in other income (expense), net in

the consolidated statements of operations.

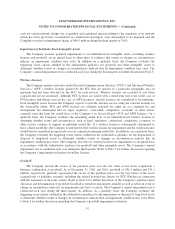

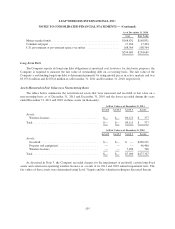

Cash Equivalents and Short-Term Investments

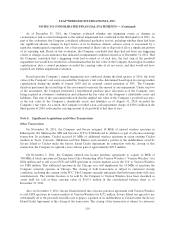

As of December 31, 2011 and December 31, 2010, all of the Company’s short-term investments were debt

securities with contractual maturities of less than one year and were classified as available-for-sale. The fair

value of the Company’s cash equivalents, short-term investments in obligations of the U.S. government and

government agencies and its short-term investments in commercial paper is determined using observable market-

based inputs for similar assets, which primarily include yield curves and time-to-maturity factors. Such

investments are therefore considered to be Level 2 items.

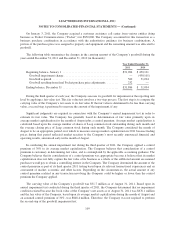

Available-for-sale securities were comprised as follows as of December 31, 2011 and December 31, 2010

(in thousands):

As of December 31, 2011

Cost Fair Value

Money market funds ............................................. $224,383 $224,383

Commercial paper ............................................... 165,201 165,202

U.S. government or government agency securities ...................... 293,626 293,610

$683,210 $683,195

104