Cricket Wireless 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Deferred Stock Units

Under guidance for share-based compensation, the fair value of the Company’s deferred stock units is based

on the grant date fair value of the Company’s common stock. All deferred stock units were granted with no

purchase price. There were no deferred stock units issued, vested or outstanding during 2010 and 2009. The

Company issued 90,000 deferred stock units at a weighted-average grant date fair value of $12.39 per share

during the year ended December 31, 2011. The deferred stock units contain performance conditions which will

determine the number of shares that will be ultimately issued when the awards vest, which could result in the

Company issuing 90,000 to 320,000 shares. The shares underlying these deferred stock units will be issued and

vest upon the completion of a three year service period. The Company has estimated the total number of shares

that will vest and the related share-based expense in accordance with the authoritative guidance for share-based

payments with performance conditions. At December 31, 2011, total unrecognized compensation cost related to

deferred stock units was $1.9 million, which is expected to be recognized over a weighted-average period of

2.0 years.

Employee Stock Purchase Plan

The Company’s Employee Stock Purchase Plan (the “ESP Plan”) allows eligible employees to purchase

shares of common stock during a specified offering period. The purchase price is 85% of the lower of the fair

market value of such stock on the first or last day of the offering period. Employees may authorize the Company

to withhold up to 15% of their compensation during any offering period for the purchase of shares under the ESP

Plan, subject to certain limitations. A total of 800,000 shares of common stock were reserved for issuance under

the ESP Plan, and a total of 216,254 shares remained available for issuance under the ESP Plan as of

December 31, 2011. The most recent offering period under the ESP Plan was from July 1, 2011 through

December 31, 2011.

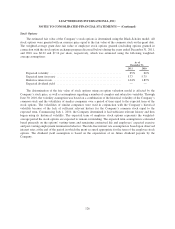

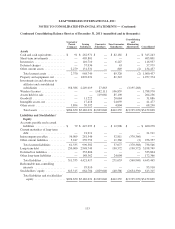

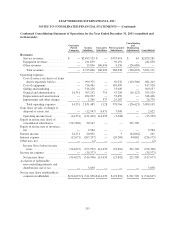

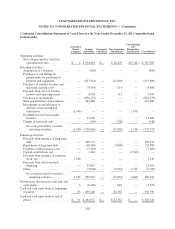

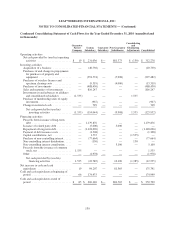

Allocation of Share-based Compensation Expense

Total share-based compensation expense related to all of the Company’s share-based awards for the years

ended December 31, 2011, 2010 and 2009 was allocated in the consolidated statements of operations as follows

(in thousands, except per share data):

Year Ended December 31,

2011 2010 2009

Cost of service .......................................... $ 1,734 $ 3,673 $ 3,546

Selling and marketing expense .............................. 1,985 5,781 6,264

General and administrative expense .......................... 11,609 27,155 32,903

Share-based compensation expense ........................ $15,328 $36,609 $42,713

Share-based compensation expense per share:

Basic ................................................ $ 0.20 $ 0.48 $ 0.59

Diluted .............................................. $ 0.20 $ 0.48 $ 0.59

Note 13. Employee Savings and Retirement Plan

The Company’s 401(k) plan allows eligible employees to contribute up to 30% of their salary, subject to

annual limits. The Company matches a portion of the employee contributions and may, at its discretion, make

additional contributions based upon earnings. The Company’s contributions were approximately $5.6 million,

$5.4 million and $4.8 million for the years ended December 31, 2011, 2010 and 2009, respectively.

129