Cricket Wireless 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

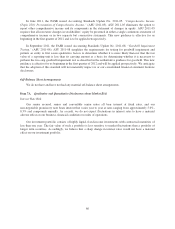

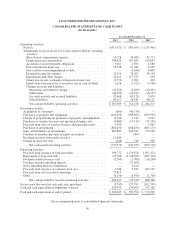

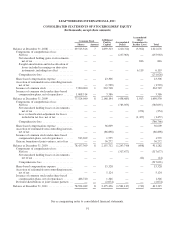

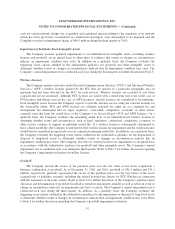

LEAP WIRELESS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except share amounts)

Common Stock Additional

Paid-In

Capital

Accumulated

Deficit

Accumulated

Other

Comprehensive

Income (Loss) TotalShares Amount

Balance at December 31, 2008 .................. 69,515,526 7 1,839,313 (220,722) (5,922) 1,612,676

Components of comprehensive loss:

Net loss ................................ — — — (237,963) — (237,963)

Net unrealized holding gains on investments,

netoftax ............................. — — — — 816 816

Swaplet amortization and reclassification of

losses included in earnings on derivative

instruments, including tax effect .......... — — — — 6,119 6,119

Comprehensive loss ...................... (231,028)

Share-based compensation expense ............ — — 43,306 — — 43,306

Accretion of redeemable non-controlling interests,

netoftax ............................... — — (1,529) — — (1,529)

Issuance of common stock ................... 7,000,000 1 263,718 — — 263,719

Issuance of common stock under share-based

compensation plans, net of repurchases ....... 1,008,514 — 3,386 — — 3,386

Balance at December 31, 2009 .................. 77,524,040 8 2,148,194 (458,685) 1,013 1,690,530

Components of comprehensive loss:

Net loss ................................ — — — (785,055) — (785,055)

Net unrealized holding losses on investments,

netoftax ............................. — — — — (254) (254)

Less: reclassification adjustment for losses

included in net loss, net of tax ............ — — — — (1,457) (1,457)

Comprehensive loss ...................... (786,766)

Share-based compensation expense ............ — — 36,609 — — 36,609

Accretion of redeemable non-controlling interests,

netoftax ............................... — — (86,898) — — (86,898)

Issuance of common stock under share-based

compensation plans, net of repurchases ....... 913,269 — 1,535 — — 1,535

Gain on formation of joint ventures, net of tax . . . — — 56,272 — — 56,272

Balance at December 31, 2010 .................. 78,437,309 8 2,155,712 (1,243,740) (698) 911,282

Components of comprehensive loss:

Net loss ................................ — — — (317,677) — (317,677)

Net unrealized holding losses on investments,

netoftax ............................. — — — — (14) (14)

Comprehensive loss ...................... (317,691)

Share-based compensation expense ............ — — 15,328 — — 15,328

Accretion of redeemable non-controlling interests,

netoftax ............................... — — 5,124 — — 5,124

Issuance of common stock under share-based

compensation plans, net of repurchases ....... 486,740 — 1,346 — — 1,346

Preferred distributions to joint venture partners . . . — — (2,074) — — (2,074)

Balance at December 31, 2011 .................. 78,924,049 8 2,175,436 (1,561,417) (712) 613,315

See accompanying notes to consolidated financial statements.

91