Cricket Wireless 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

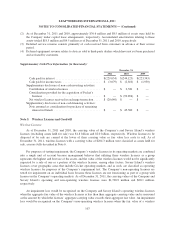

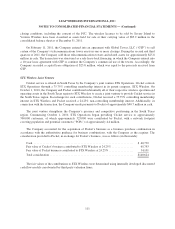

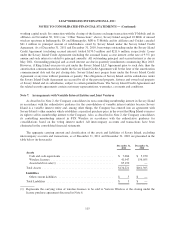

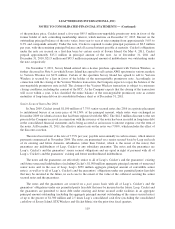

Note 9. Long-Term Debt

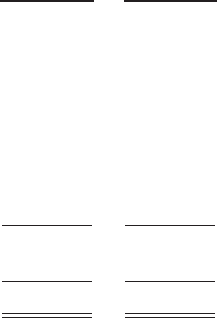

Long-term debt as of December 31, 2011 and 2010 was comprised of the following (in thousands):

December 31,

2011

December 31,

2010

Convertible senior notes due 2014 ............................... $ 250,000 $ 250,000

Unsecured senior notes due 2015 ............................... 300,000 300,000

Non-negotiable promissory note due 2015 ........................ 21,911 45,500

Senior secured notes due 2016 .................................. 1,100,000 1,100,000

Unamortized discount on $1,100 million senior secured notes due

2016 .................................................... (29,601) (34,962)

Unsecured senior notes due 2020 ............................... 1,600,000 1,200,000

Unamortized discount on $1,600 million unsecured senior notes due

2020 .................................................... (21,650) (19,968)

3,220,660 2,840,570

Current maturities of long-term debt ............................. (21,911) (8,500)

$3,198,749 $2,832,070

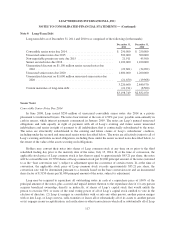

Senior Notes

Convertible Senior Notes Due 2014

In June 2008, Leap issued $250 million of unsecured convertible senior notes due 2014 in a private

placement to institutional buyers. The notes bear interest at the rate of 4.50% per year, payable semi-annually in

cash in arrears, which interest payments commenced in January 2009. The notes are Leap’s general unsecured

obligations and rank equally in right of payment with all of Leap’s existing and future senior unsecured

indebtedness and senior in right of payment to all indebtedness that is contractually subordinated to the notes.

The notes are structurally subordinated to the existing and future claims of Leap’s subsidiaries’ creditors,

including under the secured and unsecured senior notes described below. The notes are effectively junior to all of

Leap’s existing and future secured obligations, including those under the senior secured notes described below, to

the extent of the value of the assets securing such obligations.

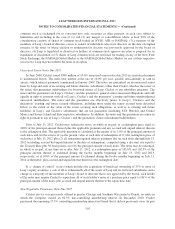

Holders may convert their notes into shares of Leap common stock at any time on or prior to the third

scheduled trading day prior to the maturity date of the notes, July 15, 2014. If, at the time of conversion, the

applicable stock price of Leap common stock is less than or equal to approximately $93.21 per share, the notes

will be convertible into 10.7290 shares of Leap common stock per $1,000 principal amount of the notes (referred

to as the “base conversion rate”), subject to adjustment upon the occurrence of certain events. If, at the time of

conversion, the applicable stock price of Leap common stock exceeds approximately $93.21 per share, the

conversion rate will be determined pursuant to a formula based on the base conversion rate and an incremental

share factor of 8.3150 shares per $1,000 principal amount of the notes, subject to adjustment.

Leap may be required to repurchase all outstanding notes in cash at a repurchase price of 100% of the

principal amount of the notes, plus accrued and unpaid interest thereon to the repurchase date if (1) any person

acquires beneficial ownership, directly or indirectly, of shares of Leap’s capital stock that would entitle the

person to exercise 50% or more of the total voting power of all of Leap’s capital stock entitled to vote in the

election of directors, (2) Leap (i) merges or consolidates with or into any other person, another person merges

with or into Leap, or Leap conveys, sells, transfers or leases all or substantially all of its assets to another person

or (ii) engages in any recapitalization, reclassification or other transaction in which all or substantially all of Leap

117