Cricket Wireless 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

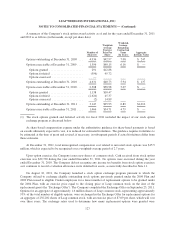

determined on a grant-by-grant basis and were intended to result in the fair value, for accounting purposes, of the

replacement options being approximately 50% of the fair value of the surrendered options using the Black-

Scholes stock option pricing model. The Exchange Offer did not result in any additional share-based

compensation expense. Executive officers and members of the Company’s board of directors were not permitted

to participate in the Exchange Offer. The impacts related to the amount of stock options granted, forfeited and

outstanding and the related values are included in the table above.

Restricted Stock

Under guidance for share-based payments, the fair value of the Company’s restricted stock awards is based

on the grant date fair value of the Company’s common stock. Prior to 2009, all restricted stock awards were

granted with a purchase price of $0.0001 per share. During 2011 and 2010, all restricted stock awards were

granted with no purchase price. For those restricted stock awards granted with a purchase price, the restricted

stock grant agreements allow the Company to repurchase unvested shares at the option, but not the obligation, of

the Company for a period of sixty days, commencing ninety days after the employee has a termination event. If

the Company elects to repurchase all or any portion of the unvested shares, it may do so at the original purchase

price per share. The weighted-average grant date fair value of the restricted stock awards was $11.84 and $15.27

per share during the years ended December 31, 2011 and 2010, respectively.

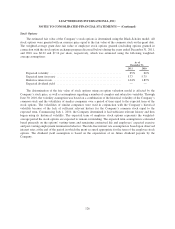

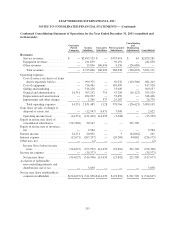

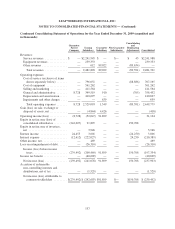

A summary of the Company’s restricted stock award activity as of and for the years ended

December 31, 2011 and 2010 is as follows (in thousands, except per share data):

Number of

Shares

Weighted-

Average

Grant Date

Fair Value

Per Share

Restricted stock awards outstanding at December 31, 2009 .............. 1,731 $41.17

Shares issued ................................................. 982 15.27

Shares forfeited ............................................... (201) 38.90

Shares vested ................................................. (394) 45.69

Restricted stock awards outstanding at December 31, 2010 .............. 2,118 $28.54

Shares issued ................................................. 684 11.84

Shares forfeited ............................................... (353) 29.06

Shares vested ................................................. (484) 36.51

Restricted stock awards outstanding at December 31, 2011 .............. 1,965 $20.68

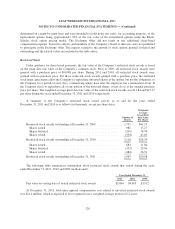

The following table summarizes information about restricted stock awards that vested during the years

ended December 31, 2011, 2010 and 2009 (in thousands):

Year Ended December 31,

2011 2010 2009

Fair value on vesting date of vested restricted stock awards .......... $5,864 $4,965 $3,912

At December 31, 2011, total unrecognized compensation cost related to unvested restricted stock awards

was $21.4 million, which is expected to be recognized over a weighted-average period of 2.2 years.

128