Cricket Wireless 2011 Annual Report Download - page 65

Download and view the complete annual report

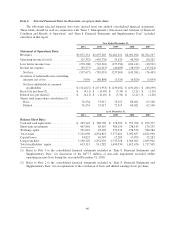

Please find page 65 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The carrying value of our goodwill was $31.7 million as of August 31, 2011. Based upon our annual

impairment test conducted during the third quarter of 2011, we determined that no impairment condition existed

because the book value of our net assets as of August 31, 2011 was $676.1 million and the fair value of our

company, based upon our average market capitalization during the month of August and an assumed control

premium of 30%, was $848.4 million. Therefore, we were not required to perform the second step of the

goodwill impairment test.

As of December 31, 2011, we evaluated whether any triggering events or changes in circumstances had

occurred subsequent to our annual impairment test conducted in the third quarter of 2011. As part of this evaluation,

we considered additional qualitative factors, including whether there had been any significant adverse changes in

legal factors or in our business climate, adverse action or assessment by a regulator, unanticipated competition, loss

of key personnel or likely sale or disposal of all or a significant portion of our reporting unit. Based on this

evaluation, we concluded that there had not been any triggering events or changes in circumstances that indicated an

impairment condition existed as of December 31, 2011. Had we concluded that a triggering event had occurred as of

such date, the first step of the goodwill impairment test would have resulted in a determination that the fair value of

our company (based upon our market capitalization, plus a control premium) exceeded the carrying value of our net

assets, and thus would not have required any further impairment evaluation.

Based upon on our annual impairment test conducted during the third quarter of 2010, the book value of our

net assets exceeded the fair value of our company, determined based upon our average market capitalization

during the month of August 2010 and an assumed control premium of 30%. We therefore performed the second

step of the assessment to measure the amount of any impairment. Under step two of the assessment, we

performed a hypothetical purchase price allocation as if our company was being acquired in a business

combination and estimated the fair value of our identifiable assets and liabilities. This step of the assessment

indicated that the implied fair value of our goodwill was zero, as the fair value of our identifiable assets and

liabilities as of August 31, 2010 exceeded the fair value of our company. As a result, we recorded a non-cash

impairment charge of $430.1 million in the third quarter of 2010, reducing the carrying amount of our goodwill

at that time to zero, which is more fully described in Note 5 to our consolidated financial statements included in

“Part II- Item 8. Financial Statements and Supplementary Data” in this report.

Income Taxes

We calculate income taxes in each of the jurisdictions in which we operate. This process involves

calculating the current tax expense or benefit and any deferred income tax expense or benefit resulting from

temporary differences arising from differing treatments of items for tax and accounting purposes. These

temporary differences result in deferred tax assets and liabilities. Deferred tax assets are also established for the

expected future tax benefits to be derived from our NOL carryforwards, capital loss carryforwards and income

tax credits.

We periodically assess the likelihood that our deferred tax assets will be recoverable from future taxable

income. To the extent we believe it is more likely than not that our deferred tax assets will not be recovered, we

must establish a valuation allowance. As part of this periodic assessment for the year ended December 31, 2011,

we weighed the positive and negative factors and, at this time, we do not believe there is sufficient positive

evidence to support a conclusion that it is more likely than not that all or a portion of our deferred tax assets will

be realized, except with respect to the realization of a $1.9 million Texas Margins Tax, or TMT, credit.

Accordingly, at December 31, 2011 and 2010, we recorded a valuation allowance offsetting substantially all of

our deferred tax assets. We will continue to monitor the positive and negative factors to assess whether we are

required to continue to maintain a valuation allowance. At such time as we determine that it is more likely than

not that all or a portion of the deferred tax assets are realizable, the valuation allowance will be reduced or

released in its entirety, with the corresponding benefit reflected in our tax provision. Deferred tax liabilities

associated with wireless licenses and investments in certain joint ventures cannot be considered a source of

taxable income to support the realization of deferred tax assets because these deferred tax liabilities will not

reverse until some indefinite future period when these assets are either sold or impaired for book purposes.

55