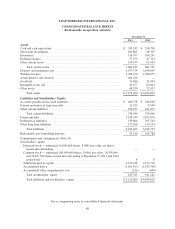

Cricket Wireless 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

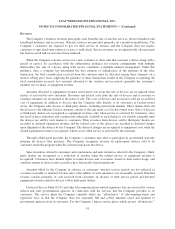

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

identification method is used to compute the realized gains and losses on investments. Investments are

periodically reviewed for impairment. If the carrying value of an investment exceeds its fair value and the decline

in value is determined to be other-than-temporary, an impairment loss is recognized for the difference.

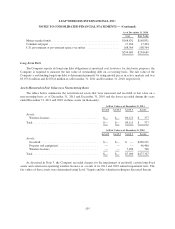

Restricted Cash, Cash Equivalents and Short-Term Investments

The Company has set aside certain amounts of cash, cash equivalents and short term investments to satisfy

certain contractual obligations and has classified such amounts as restricted in its consolidated balance sheets.

Restricted cash, cash equivalents and short-term investments are included in either other current assets or other

assets, depending on the nature of the underlying contractual obligation. As of December 31, 2011, the Company

had approximately $3.6 million and $8.8 million of restricted cash, cash equivalents and short-term investments,

included in other current assets and other assets, respectively. As of December 31, 2010, the Company had

approximately $3.6 million and $7.8 million of restricted cash, cash equivalents and short-term investments,

included in other current assets and other assets, respectively.

Fair Value of Financial Instruments

The authoritative guidance for fair value measurements defines fair value for accounting purposes,

establishes a framework for measuring fair value and provides disclosure requirements regarding fair value

measurements. The guidance defines fair value as an exit price, which is the price that would be received upon

the sale of an asset or paid upon transfer of a liability in an orderly transaction between market participants at the

measurement date. The degree of judgment utilized in measuring the fair value of assets and liabilities generally

correlates to the level of pricing observability. Assets and liabilities with readily available, actively quoted prices

or for which fair value can be measured from actively quoted prices in active markets generally have more

pricing observability and require less judgment in measuring fair value. Conversely, assets and liabilities that are

rarely traded or not quoted have less pricing observability and are generally measured at fair value using

valuation models that require more judgment. These valuation techniques involve some level of management

estimation and judgment, the degree of which is dependent on the price transparency of the asset, liability or

market and the nature of the asset or liability. The Company has categorized its assets and liabilities measured at

fair value into a three-level hierarchy in accordance with this guidance. See Note 3 for further discussion

regarding the Company’s measurement of assets and liabilities at fair value.

Inventories and Deferred Charges

Inventories consist of devices and accessories not yet placed into service and units designated for the

replacement of damaged customer devices, and are stated at the lower of cost or market using the average cost

method. Devices sold to third party dealers and nationwide retailers are recorded as deferred charges upon

shipment of the devices by the Company. The deferred charges are recognized as cost of equipment when service

is activated by the customer.

Property and Equipment

Property and equipment are initially recorded at cost. Additions and improvements are capitalized, while

expenditures that do not enhance the asset or extend its useful life are charged to operating expenses as incurred.

Depreciation is applied using the straight-line method over the estimated useful lives of the assets once the assets

are placed in service.

95