Cricket Wireless 2011 Annual Report Download - page 103

Download and view the complete annual report

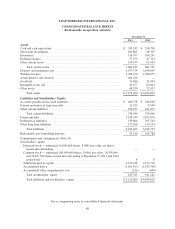

Please find page 103 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

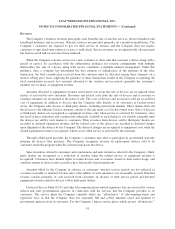

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Revenues

The Company’s business revenues principally arise from the sale of wireless services, devices (handsets and

broadband modems) and accessories. Wireless services are provided primarily on a month-to-month basis. The

Company’s customers are required to pay for their service in advance and the Company does not require

customers to sign fixed-term contracts or pass a credit check. Service revenues are recognized only after payment

has been received and services have been rendered.

When the Company activates service for a new customer, it often sells that customer a device along with a

period of service. In accordance with the authoritative guidance for revenue arrangements with multiple

deliverables, the sale of a device along with service constitutes a multiple element arrangement. Under this

guidance, once a company has determined the best estimate of selling price of the elements in the sales

transaction, the total consideration received from the customer must be allocated among those elements on a

relative selling price basis. Applying the guidance to these transactions results in the Company recognizing the

total consideration received, less amounts allocated to the wireless service period (generally the customer’s

monthly service plan), as equipment revenue.

Amounts allocated to equipment revenues and related costs from the sale of devices are recognized when

service is activated by new customers. Revenues and related costs from the sale of devices and accessories to

existing customers are recognized at the point of sale. The costs of devices and accessories sold are recorded in

cost of equipment. In addition to devices that the Company sells directly to its customers at Cricket-owned

stores, the Company sells devices to third-party dealers, including nationwide retailers. These dealers then sell

the devices to the ultimate Cricket customer, similar to the sale made at a Cricket-owned store. Sales of devices

to third-party dealers are recognized as equipment revenues only when service is activated by customers, since

the level of price reductions and commissions ultimately available to such dealers is not reliably estimable until

the devices are sold by such dealers to customers. Thus, revenues from devices sold to third-party dealers are

recorded as deferred equipment revenue and the related costs of the devices are recorded as deferred charges

upon shipment of the devices by the Company. The deferred charges are recognized as equipment costs when the

related equipment revenue is recognized, which occurs when service is activated by the customer.

Through a third-party provider, the Company’s customers may elect to participate in an extended warranty

program for devices they purchase. The Company recognizes revenue on replacement devices sold to its

customers under the program when the customer purchases the device.

Sales incentives offered to customers and commissions and sales incentives offered to the Company’s third-

party dealers are recognized as a reduction of revenue when the related service or equipment revenue is

recognized. Customers have limited rights to return devices and accessories based on time and/or usage, and

customer returns of devices and accessories have historically been insignificant.

Amounts billed by the Company in advance of customers’ wireless service periods are not reflected in

accounts receivable or deferred revenue since collectability of such amounts is not reasonably assured. Deferred

revenue consists primarily of cash received from customers in advance of their service period and deferred

equipment revenue related to devices sold to third-party dealers.

Universal Service Fund, E-911 and other telecommunications-related regulatory fees are assessed by various

federal and state governmental agencies in connection with the services that the Company provides to its

customers. The service plans the Company currently offers are “all-inclusive” of telecommunications and

regulatory fees, in that the Company does not separately bill and collect amounts owed and remitted to

government agencies from its customers. For the Company’s legacy service plans, which are not “all-inclusive,”

93