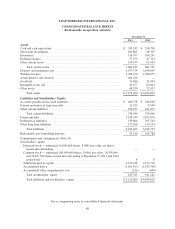

Cricket Wireless 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

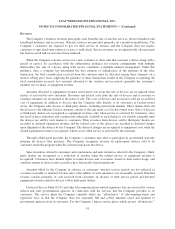

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

the Company separately bills and collects from its customers amounts owed and remitted to government

agencies. Regulatory fees and telecommunications taxes separately billed and collected from the Company’s

customers are recorded in service revenues. Amounts owed to government agencies are recorded in cost of

service. During the years ended December 31, 2011, 2010 and 2009 the total amount of regulatory fees and

telecommunications taxes separately billed and collected from customers and recorded in service revenues was

$32.6 million, $108.4 million and $96.4 million, respectively. Sales, use and excise taxes for all service plans are

reported on a net basis.

Costs and Expenses

The Company’s costs and expenses include:

Cost of Service. The major components of cost of service are: charges from other communications

companies for long distance, roaming and content download services provided to the Company’s customers;

charges from other communications companies for their transport and termination of calls originated by the

Company’s customers and destined for customers of other networks; expenses for tower and network facility

rent, engineering operations, field technicians and utility and maintenance charges, and salary and overhead

charges associated with these functions; and regulatory fees and telecommunications taxes, including Universal

Service Fund and E-911 fees.

Cost of Equipment. Cost of equipment primarily includes the cost of devices and accessories purchased

from third-party vendors and resold to the Company’s customers in connection with its services, as well as the

lower of cost or market write-downs associated with excess or obsolete devices and accessories.

Selling and Marketing. Selling and marketing expenses primarily include advertising expenses,

promotional and public relations costs associated with acquiring new customers, store operating costs (such as

retail associates’ salaries and rent), and salary and overhead charges associated with selling and marketing

functions.

General and Administrative. General and administrative expenses primarily include call center and other

customer care program costs and salary, overhead and outside consulting costs associated with the Company’s

customer care, billing, information technology, finance, human resources, accounting, legal and executive

functions.

Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity at the time of purchase of three

months or less to be cash equivalents. The Company invests its cash with major financial institutions in money

market funds, short-term U.S. Treasury securities and other securities such as prime-rated short-term commercial

paper. The Company has not experienced any significant losses on its cash and cash equivalents.

Short-Term Investments

Short-term investments generally consist of highly liquid, fixed-income investments with an original

maturity at the time of purchase of greater than three months. Such investments consist of commercial paper,

asset-backed commercial paper and obligations of the U.S. government and government agencies.

Investments are classified as available-for-sale and stated at fair value. The net unrealized gains or losses on

available-for-sale securities are reported as a component of comprehensive income (loss). The specific

94