Cricket Wireless 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

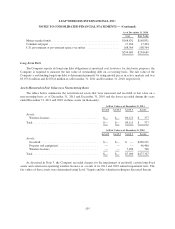

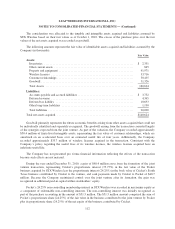

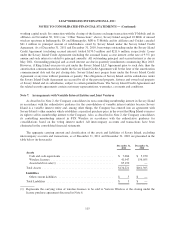

(2) As of December 31, 2011 and 2010, approximately $30.6 million and $8.5 million of assets were held by

the Company under capital lease arrangements, respectively. Accumulated amortization relating to these

assets totaled $18.5 million and $4.5 million as of December 31, 2011 and 2010, respectively.

(3) Deferred service revenue consists primarily of cash received from customers in advance of their service

period.

(4) Deferred equipment revenue relates to devices sold to third-party dealers which have not yet been purchased

and activated by customers.

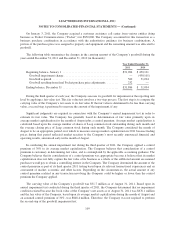

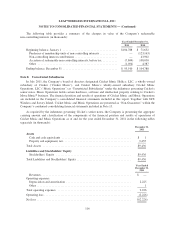

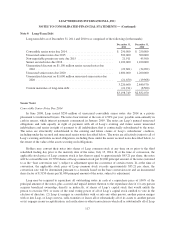

Supplementary Cash Flow Information (in thousands):

December 31,

2011 2010 2009

Cash paid for interest .............................. $(229,034) $(244,123) $(223,343)

Cash paid for income taxes ......................... $ (3,079) $ (2,810) $ (1,950)

Supplementary disclosure of non-cash investing activities:

Contribution of wireless licenses ..................... $ — $ 2,381 $ —

Consideration provided for the acquisition of Pocket’s

business ...................................... $ — $ (99,894) $ —

Net wireless licenses received in exchange transaction .... $ (20,649) $ — $ —

Supplementary disclosure of non-cash financing activities:

Note assumed as consideration for purchase of remaining

interest in Denali ............................... $ — $ 45,500 $ —

Note 5. Wireless Licenses and Goodwill

Wireless Licenses

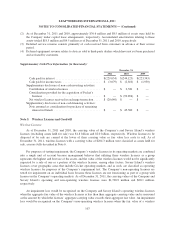

As of December 31, 2011 and 2010, the carrying value of the Company’s and Savary Island’s wireless

licenses (excluding assets held for sale) was $1.8 billion and $2.0 billion, respectively. Wireless licenses to be

disposed of by sale are carried at the lower of their carrying value or fair value less costs to sell. As of

December 31, 2011, wireless licenses with a carrying value of $204.3 million were classified as assets held for

sale, as more fully described in Note 6.

For purposes of testing impairment, the Company’s wireless licenses in its operating markets are combined

into a single unit of account because management believes that utilizing these wireless licenses as a group

represents the highest and best use of the assets, and the value of the wireless licenses would not be significantly

impacted by a sale of one or a portion of the wireless licenses, among other factors. Savary Island’s wireless

licenses cover geographic areas that include Cricket operating markets, and as such, are classified as operating

wireless licenses for purposes of the Company’s impairment test. The Company’s non-operating licenses are

tested for impairment on an individual basis because these licenses are not functioning as part of a group with

licenses in the Company’s operating markets. As of December 31, 2011, the carrying values of the Company and

Savary Island’s operating and non-operating wireless licenses were $1,728.9 million and $60.1 million,

respectively.

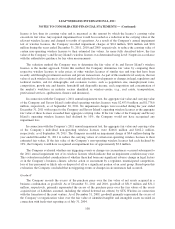

An impairment loss would be recognized on the Company and Savary Island’s operating wireless licenses

when the aggregate fair value of the wireless licenses is less than their aggregate carrying value and is measured

as the amount by which the licenses’ aggregate carrying value exceeds their aggregate fair value. An impairment

loss would be recognized on the Company’s non-operating wireless licenses when the fair value of a wireless

107