Cricket Wireless 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

In the event Sprint is involved in a change-of-control transaction, the agreement would bind Sprint’s

successor-in-interest.

Capital and Operating Leases

The Company has entered into non-cancelable operating lease agreements to lease its administrative and

retail facilities, and sites for towers, equipment and antennae required for the operation of its wireless network.

These leases typically include renewal options and escalation clauses, some of which escalation clauses are based

on the consumer price index. In general, site leases have five- to ten-year initial terms with four five-year renewal

options.

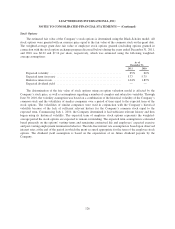

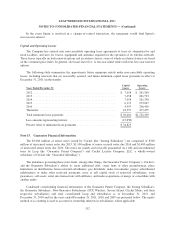

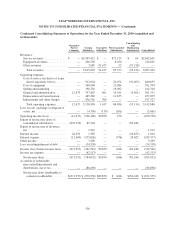

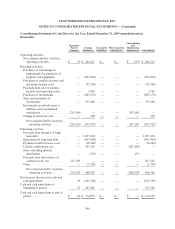

The following table summarizes the approximate future minimum rentals under non-cancelable operating

leases, including renewals that are reasonably assured, and future minimum capital lease payments in effect at

December 31, 2011 (in thousands):

Years Ended December 31:

Capital

Leases

Operating

Leases

2012 ......................................................... $ 7,058 $ 261,260

2013 ......................................................... 7,058 261,793

2014 ......................................................... 7,058 261,338

2015 ......................................................... 6,113 253,047

2016 ......................................................... 4,597 206,416

Thereafter .................................................... 18,597 477,455

Total minimum lease payments ................................... $50,481 $1,721,309

Less amounts representing interest ................................. (15,658)

Present value of minimum lease payments ........................... $34,823

Note 15. Guarantor Financial Information

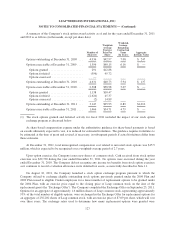

The $3,000 million of senior notes issued by Cricket (the “Issuing Subsidiary”) are comprised of $300

million of unsecured senior notes due 2015, $1,100 million of senior secured notes due 2016 and $1,600 million

of unsecured senior notes due 2020. The notes are jointly and severally guaranteed on a full and unconditional

basis by Leap (the “Guarantor Parent Company”) and Cricket License Company, LLC, a wholly-owned

subsidiary of Cricket (the “Guarantor Subsidiary”).

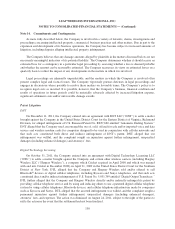

The indentures governing these notes limit, among other things, the Guarantor Parent Company’s, Cricket’s

and the Guarantor Subsidiary’s ability to: incur additional debt; create liens or other encumbrances; place

limitations on distributions from restricted subsidiaries; pay dividends; make investments; prepay subordinated

indebtedness or make other restricted payments; issue or sell capital stock of restricted subsidiaries; issue

guarantees; sell assets; enter into transactions with affiliates; and make acquisitions or merge or consolidate with

another entity.

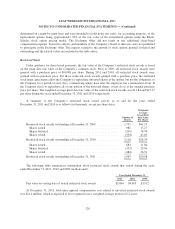

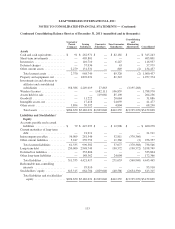

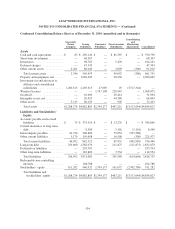

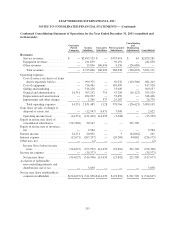

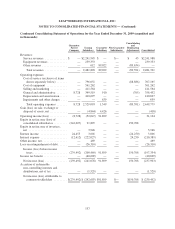

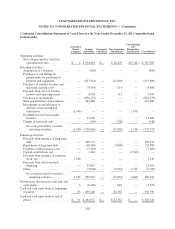

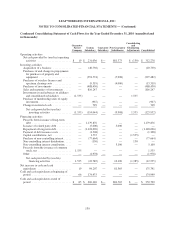

Condensed consolidating financial information of the Guarantor Parent Company, the Issuing Subsidiary,

the Guarantor Subsidiary, Non-Guarantor Subsidiaries (STX Wireless, Savary Island, Cricket Music and their

respective subsidiaries) and total consolidated Leap and subsidiaries as of December 31, 2011 and

December 31, 2010 and for the years ended December 31, 2011, 2010 and 2009 are presented below. The equity

method of accounting is used to account for ownership interests in subsidiaries, where applicable.

132