Cricket Wireless 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• We made payments of $12.1 million to repay and discharge all amounts outstanding under LCW’s former

senior secured credit agreement.

• We made payments of $53.5 million to acquire all of the remaining membership interests we did not

previously own in Denali.

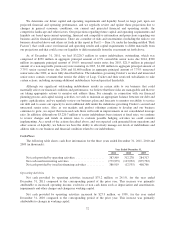

Net cash provided by financing activities was $408.8 million during the year ended December 31, 2009,

which included the effects of the following transactions:

• We issued $1,100 million of 7.75% senior secured notes due 2016, which resulted in net proceeds of

$1,057.5 million. This note issuance was offset by the payment of $875.3 million to repay and discharge

all amounts outstanding under our former credit agreement. In addition, we incurred $16.2 million in debt

issuance costs in connection with the issuance of the senior secured notes.

• We made payments of $2.3 million under our former credit agreement during the first quarter of 2009 and

a subsidiary of LCW made payments of $20.3 million under its former senior secured credit agreement,

which included a $17.0 million repayment of principal in connection with an amendment to the senior

secured credit agreement.

• We sold an aggregate of 7,000,000 shares of Leap common stock in an underwritten public offering,

resulting in aggregate net proceeds of $263.7 million.

• We issued common stock upon the exercise of stock options held by our employees, resulting in

aggregate net proceeds of $3.4 million.

Senior Notes

Discharge of Indenture and Loss on Extinguishment of Debt

On November 4, 2010, we launched a tender offer to purchase for cash our $1,100 million in aggregate

principal amount of outstanding 9.375% senior notes due 2014. Concurrently with the tender offer, we also

solicited consents from the holders of the notes to eliminate certain covenants in and amend certain provisions of

the indenture governing the notes. We accepted tenders on November 19, 2010 and December 6, 2010 for

approximately $915.8 million in aggregate principal amount of the notes in connection with the tender offer. The

holders of the accepted notes received total consideration of $1,050.63 per $1,000 principal amount of notes

tendered prior to the early settlement date, which included a $20 consent payment per $1,000 principal amount of

notes tendered, and $1,030.63 per $1,000 principal amount of notes tendered thereafter. The total cash payment

to purchase the tendered notes, including accrued and unpaid interest up to, but excluding, the applicable date of

purchase, was approximately $996.5 million, which we obtained from the issuance of $1,200 million of 7.75%

senior notes due 2020 on November 19, 2010, as discussed below.

On December 20, 2010, we completed the redemption of all of the remaining 9.375% senior notes due 2014

pursuant to the optional redemption provisions of the notes at a price of 104.688% of the principal amount of

outstanding notes, plus accrued and unpaid interest to, but not including, the redemption date. The total cash

payment for the redemption was approximately $195.1 million. In connection with the completion of the

redemption, the indenture governing the notes was satisfied and discharged in accordance with its terms.

As a result of the repurchase and redemption of all of our 9.375% senior notes due 2014, we recognized a

$54.5 million loss on extinguishment of debt during the year ended December 31, 2010, which was comprised of

$46.6 million in tender offer consideration (including $18.3 million in consent payments), $1.1 million in dealer

manager fees, $8.6 million in redemption premium, $10.7 million in unamortized debt issuance costs and

$0.2 million in related professional fees, net of $12.7 million in unamortized premium.

74