Cricket Wireless 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.However, as more fully described in Note 4 to our consolidated financial statements included in “Item 8.

Financial Statements and Supplementary Data” of this report, we have non-financial assets measured at fair value

using Level 3 inputs on a non-recurring basis.

Generally, our results of operations are not significantly impacted by our assets and liabilities accounted for

at fair value due to the nature of each asset and liability.

We continue to report our long-term debt obligations at amortized cost and disclose the fair value of such

obligations.

Capital Expenditures, Significant Acquisitions and Other Transactions

Capital Expenditures

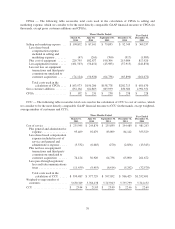

During the year ended December 31, 2011, we incurred approximately $441.7 million of capital

expenditures. These capital expenditures were primarily for the ongoing maintenance and development of our

network and other business assets and the initial deployment of next-generation LTE network technology. During

the year ended December 31, 2010, we incurred approximately $398.9 million of capital expenditures. These

capital expenditures were primarily for the ongoing growth and development of markets in commercial

operations and other internal capital projects.

Total capital expenditures for 2012 are expected to be between $600 million and $650 million. These capital

expenditures are primarily expected to support our initial deployment of LTE network technology, the ongoing

maintenance and development of our network and other business assets and other capital projects.

We currently target annual capital expenditures to support the ongoing maintenance and development of our

network and other business assets in the mid-teens as a percentage of our annual service revenues generated in

our current network footprint, and we currently expect to continue capital expenditures in a similar range over the

next several years. The actual amount of capital expenditures we spend in future years for these purposes may

vary as a result of numerous factors, including our then-available capital resources and customer usage of our

network resources.

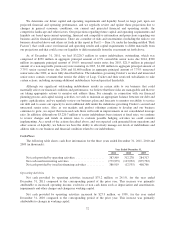

As previously noted, we currently plan to deploy next-generation LTE network technology across

approximately two-thirds of our current network footprint over the next two to three years. We successfully

launched a commercial trial market in late 2011 and plan to cover up to approximately 25 million POPs with

LTE in 2012. Capital expenditures for the deployment of LTE are currently anticipated to be less than $10 per

covered POP. Approximately half of the estimated capital expenditures for LTE deployment are included in our

capital expense budget for the ongoing maintenance and development of our network and other business assets.

The actual amount we spend to deploy LTE each year will depend upon multiple factors, including the scope and

pace of our deployment activities.

Other Transactions

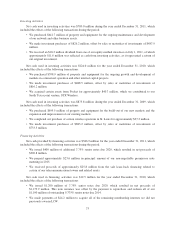

On November 30, 2011, we and Savary Island assigned 10 MHz of unused wireless spectrum in

Indianapolis, IN, Minneapolis, MN and Syracuse, NY to T-Mobile and its affiliates as part of a license exchange

transaction. In exchange, Cricket received 10 MHz of additional wireless spectrum in seven existing Cricket

markets in Texas, Colorado, Oklahoma and New Mexico and canceled a portion of the indebtedness owed by

Savary Island to Cricket. In connection with this transaction we recognized a non-cash net gain of approximately

$20.5 million.

On November 3, 2011, Savary Island entered into a license purchase agreement with Verizon Wireless to

sell AWS spectrum in various markets to Verizon Wireless for $172 million. Savary Island has agreed to use

substantially all of the proceeds from this sale to prepay a portion of its indebtedness to Cricket at the closing of

80