Cricket Wireless 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

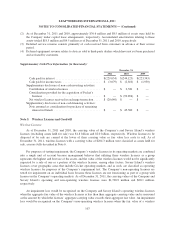

working capital needs. In connection with the closing of the license exchange transaction with T-Mobile and its

affiliates on November 30, 2011 (see “-Other Transactions” above), Savary Island assigned 10 MHz of unused

wireless spectrum in Indianapolis, IN and Minneapolis, MN to T-Mobile and its affiliates and Cricket canceled

$41.1 million in principal amount of indebtedness owed by Savary Island under the Savary Island Credit

Agreement. As of December 31, 2011 and December 31, 2010, borrowings outstanding under the Savary Island

Credit Agreement (excluding accrued interest) totaled $170.5 million and $211.6 million, respectively. Loans

under the Savary Island Credit Agreement (including the assumed loans) accrue interest at the rate of 9.5% per

annum and such interest is added to principal annually. All outstanding principal and accrued interest is due in

May 2021. Outstanding principal and accrued interest are due in quarterly installments commencing May 2018.

However, if Ring Island exercises its put under the Savary Island LLC Agreement prior to such date, then the

amortization commencement date under the Savary Island Credit Agreement will be the later of the amortization

commencement date and the put closing date. Savary Island may prepay loans under the Savary Island Credit

Agreement at any time without premium or penalty. The obligations of Savary Island and its subsidiaries under

the Savary Island Credit Agreement are secured by all of the personal property, fixtures and owned real property

of Savary Island and its subsidiaries, subject to certain permitted liens. The Savary Island Credit Agreement and

the related security agreements contain customary representations, warranties, covenants and conditions.

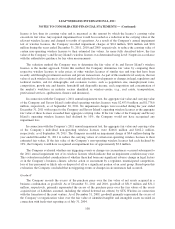

Note 7. Arrangements with Variable Interest Entities and Joint Ventures

As described in Note 2, the Company consolidates its non-controlling membership interest in Savary Island

in accordance with the authoritative guidance for the consolidation of variable interest entities because Savary

Island is a variable interest entity and, among other things, the Company has entered into an agreement with

Savary Island’s other member which establishes a specified purchase price in the event that Ring Island exercises

its right to sell its membership interest to the Company. Also, as described in Note 2, the Company consolidates

its controlling membership interest in STX Wireless in accordance with the authoritative guidance for

consolidations based on the voting interest model. All intercompany accounts and transactions have been

eliminated in the consolidated financial statements.

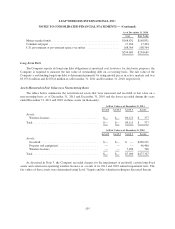

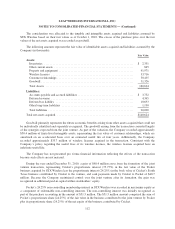

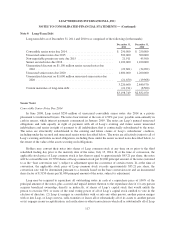

The aggregate carrying amount and classification of the assets and liabilities of Savary Island, excluding

intercompany accounts and transactions, as of December 31, 2011 and December 31, 2010 are presented in the

table below (in thousands):

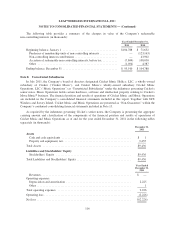

December 31,

2011

December 31,

2010

Assets

Cash and cash equivalents ................................... $ 7,084 $ 5,250

Wireless licenses .......................................... 41,947 156,055

Assets held for sale(1) ...................................... 85,190 —

Total Assets ................................................ $134,221 $161,305

Liabilities

Other current liabilities ..................................... $ 5 $ —

Total Liabilities ............................................. $ 5 $ —

(1) Represents the carrying value of wireless licenses to be sold to Verizon Wireless at the closing under the

license purchase agreement discussed in Note 6.

115