Cricket Wireless 2011 Annual Report Download - page 74

Download and view the complete annual report

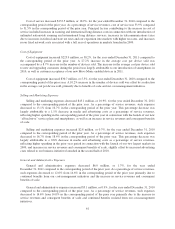

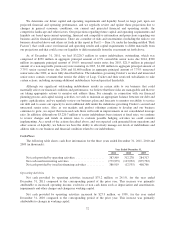

Please find page 74 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with our issuance of $1,100 million of senior secured notes in June 2009 we repaid all

principal amounts outstanding under our former credit agreement, which amounted to approximately $875.3

million, together with accrued interest and related expenses, a prepayment premium of $17.5 million and a

payment of $8.5 million in connection with the unwinding of associated interest rate swap agreements. In

connection with such repayment, we terminated the former credit agreement and the $200 million revolving

credit facility thereunder. As a result of the termination of the former credit agreement, we recognized a $26.3

million loss on extinguishment of debt during the year ended December 31, 2009, which was comprised of the

$17.5 million prepayment premium, $7.5 million of unamortized debt issuance costs and $1.3 million of

unamortized accumulated other comprehensive loss associated with our interest rate swaps.

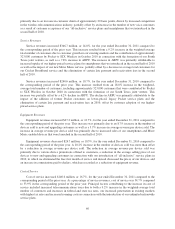

Income Tax Expense

During the year ended December 31, 2011, we recorded income tax expense of $39.4 million compared to

income tax expense of $42.5 million recognized in the corresponding period of the prior year. The decrease in

income tax expense during the year ended December 31, 2011 compared to the prior year period was primarily

due to a $23.3 million decrease in income tax expense due to the deferred tax effects of our joint venture

investments, offset in part by a net $6.3 million increase in the current year associated with both the amortization

of wireless licenses and the deferred tax effects of the license exchange transaction we and Savary Island entered

into with T-Mobile. In addition, during the year ended December 31, 2010, we recorded a $15.5 million income

tax benefit in connection with the impairment of our goodwill.

During the year ended December 31, 2010, we recorded income tax expense of $42.5 million compared to

income tax expense of $40.6 million in the corresponding period of the prior year. The increase in income tax

expense during the year ended December 31, 2010 compared to the prior year period was primarily due to a

$20.0 million increase in income tax expense due to the deferred tax effects of our former investments in LCW

Wireless LLC, or LCW, and Denali and our investments in STX Wireless. This income tax expense was partially

offset by a $15.5 million income tax benefit associated with the deferred tax effect related to the impairment of

our goodwill during the year ended December 31, 2010.

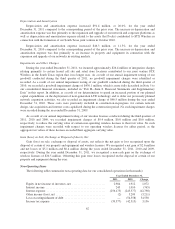

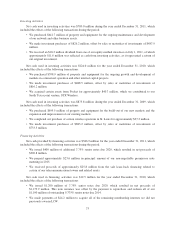

Unrestricted Subsidiaries

In July 2011, Leap’s board of directors designated Cricket Music Holdco, LLC (a wholly-owned subsidiary

of Cricket, or Cricket Music) and Cricket Music’s wholly-owned subsidiary Cricket Music Operations, LLC, or

Music Operations, as “Unrestricted Subsidiaries” under the indentures governing our senior notes. Cricket Music

and Music Operations hold certain hardware, software and intellectual property relating to our Muve Music

business. During the year ended December 31, 2011, Cricket Music and Music Operations had no operations or

revenues. Therefore, the most significant components of the financial position and results of operations of our

unrestricted subsidiaries were property and equipment and depreciation expense. As of December 31, 2011,

property and equipment of our unrestricted subsidiaries was approximately $9.4 million, and for the year ended

December 31, 2011, depreciation expense of our unrestricted subsidiaries was approximately $2.2 million,

resulting in a net loss of approximately $2.2 million.

64