Cricket Wireless 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.respect to our and Savary Island’s operating wireless licenses as the aggregate fair value of these licenses

exceeded their aggregate carrying value. If the fair value of our and Savary Island’s operating wireless licenses

had declined by 10%, we would not have recognized any impairment loss.

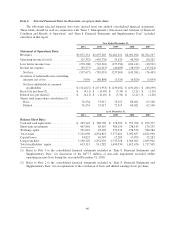

In connection with our 2011 annual impairment test, the aggregate fair value and carrying value of our

individual non-operating wireless licenses were $246.8 million and $162.2 million, respectively, as of

September 30, 2011. We recorded an impairment charge of $0.4 million during the year ended

December 31, 2011 to reduce the carrying values of certain non-operating wireless licenses to their estimated fair

values. If the fair value of our non-operating wireless licenses had each declined by 10%, we would have

recognized an impairment loss of approximately $2.2 million.

We evaluated whether any triggering events or changes in circumstances occurred subsequent to the 2011

annual impairment test of our wireless licenses which indicate that an impairment condition may exist. This

evaluation included consideration of whether there had been any significant adverse change in legal factors or in

our business climate, adverse action or assessment by a regulator, unanticipated competition, loss of key

personnel or likely sale or disposal of all or a significant portion of an asset group. Based upon this evaluation,

we concluded that no triggering events or changes in circumstances had occurred.

Goodwill

We record the excess of the purchase price over the fair value of net assets acquired in a business

combination as goodwill. Goodwill is tested for impairment annually as well as when an event or change in

circumstance indicates an impairment may have occurred. As further discussed in the notes to the consolidated

financial statements, goodwill is tested for impairment by comparing the fair value of our single reporting unit to

our carrying amount to determine if there is a potential goodwill impairment. If the fair value of the reporting

unit is less than its carrying value, an impairment loss is recorded to the extent that the implied fair value of the

goodwill of the reporting unit is less than its carrying value.

During the third quarter of each year, we assess our goodwill for impairment at the reporting unit level by

applying a fair value test. This fair value test involves a two-step process. The first step is to compare the

carrying value of our net assets to our fair value. If the fair value is determined to be less than the carrying value,

a second step is performed to measure the amount of the impairment, if any.

Significant judgments are required in connection with the annual impairment test in order to estimate our

fair value. We have generally based our determination of fair value primarily upon our average market

capitalization for the month of August, plus a control premium. Average market capitalization is calculated based

upon the average number of shares of Leap common stock outstanding during such month and the average

closing price of Leap common stock during such month. We considered the month of August to be an appropriate

period over which to measure average market capitalization in 2011 because trading prices during that period

reflected market reaction to our most recently announced financial and operating results, announced early in the

month of August.

In conducting the annual impairment test during the third quarter of 2011, we applied a control premium of

30% to our average market capitalization. We believe that consideration of a control premium is customary in

determining fair value, and is contemplated by the applicable accounting guidance. We believe that our

consideration of a control premium was appropriate because we believe that our market capitalization does not

fully capture the fair value of our business as a whole or the additional amount an assumed purchaser would pay

to obtain a controlling interest in our company. We determined the amount of the control premium as part of our

third quarter 2011 impairment testing based upon our relevant transactional experience, a review of recent

comparable telecommunications transactions and an assessment of market, economic and other factors.

Depending on the circumstances, the actual amount of any control premium realized in any transaction involving

our company could be higher or lower than the control premium that we applied.

54