Cricket Wireless 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

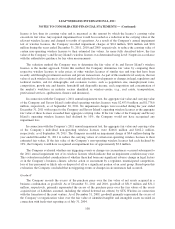

As of December 31, 2011, the Company evaluated whether any triggering events or changes in

circumstances had occurred subsequent to the annual impairment test conducted in the third quarter of 2011. As

part of this evaluation, the Company considered additional qualitative factors, including whether there had been

any significant adverse changes in legal factors or in its business climate, adverse action or assessment by a

regulator, unanticipated competition, loss of key personnel or likely sale or disposal of all or a significant portion

of its reporting unit. Based on this evaluation, the Company concluded that there had not been any triggering

events or changes in circumstances that indicated an impairment condition existed as of December 31, 2011. Had

the Company concluded that a triggering event had occurred as of such date, the first step of the goodwill

impairment test would have resulted in a determination that the fair value of the Company (based upon its market

capitalization, plus a control premium) exceeded the carrying value of its net assets, and thus would not have

required any further impairment evaluation.

Based upon the Company’s annual impairment test conducted during the third quarter of 2010, the book

value of the Company’s net assets exceeded the Company’s fair value, determined based upon its average market

capitalization during the month of August 2010 and an assumed control premium of 30%. The Company

therefore performed the second step of the assessment to measure the amount of any impairment. Under step two

of the assessment, the Company performed a hypothetical purchase price allocation as if the Company were

being acquired in a business combination and estimated the fair value of the Company’s identifiable assets and

liabilities. This step of the assessment indicated that the implied fair value of the Company’s goodwill was zero,

as the fair value of the Company’s identifiable assets and liabilities as of August 31, 2010 exceeded the

Company’s fair value. As a result, the Company recorded a non-cash impairment charge of $430.1 million in the

third quarter of 2010, reducing the carrying amount of its goodwill at that time to zero.

Note 6. Significant Acquisitions and Other Transactions

Other Transactions

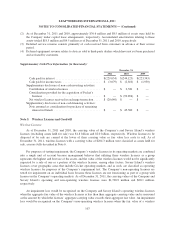

On November 30, 2011, the Company and Savary assigned 10 MHz of unused wireless spectrum in

Indianapolis, IN, Minneapolis, MN and Syracuse, NY to T-Mobile and its affiliates as part of a license exchange

transaction. In exchange, Cricket received 10 MHz of additional wireless spectrum in seven existing Cricket

markets in Texas, Colorado, Oklahoma and New Mexico and canceled a portion of the indebtedness owed by

Savary Island to Cricket under the Savary Island Credit Agreement. In connection with the closing of this

transaction, the Company recognized a non-cash net gain of approximately $20.5 million.

On November 3, 2011, the Company entered into license purchase agreements to acquire 12 MHz of

700 MHz A block spectrum in Chicago from Cellco Partnership d/b/a Verizon Wireless (“Verizon Wireless”) for

$204 million and to sell excess PCS and AWS spectrum in various markets across the U.S. to Verizon Wireless

for $188 million. This additional spectrum in the Chicago area will supplement the 10 MHz of spectrum the

Company currently operates in Chicago. The closing of both transactions is subject to customary closing

conditions, including the consent of the FCC. The Company currently anticipates that both transactions will close

simultaneously. The wireless licenses to be sold by the Company to Verizon Wireless have been classified as

assets held for sale at their carrying value of $119.1 million in the consolidated balance sheet as of

December 31, 2011.

Also on November 3, 2011, Savary Island entered into a license purchase agreement with Verizon Wireless

to sell AWS spectrum in various markets to Verizon Wireless for $172 million. Savary Island has agreed to use

substantially all of the proceeds from this sale to prepay a portion of its indebtedness to Cricket under the Savary

Island Credit Agreement at the closing of the transaction. The closing of the transaction is subject to customary

110