Cricket Wireless 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

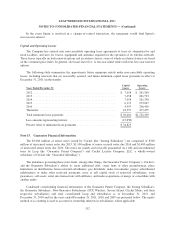

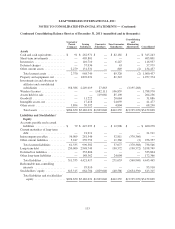

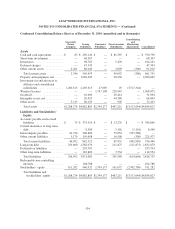

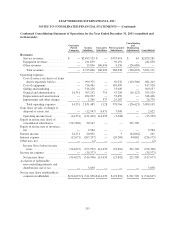

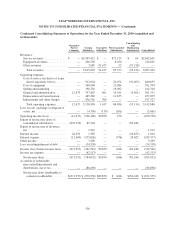

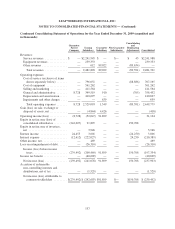

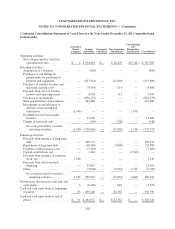

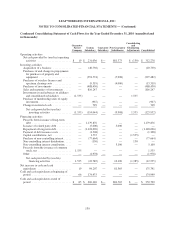

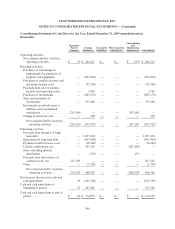

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

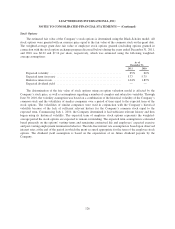

Condensed Consolidating Statement of Operations for the Year Ended December 31, 2011 (unaudited and

in thousands):

Guarantor

Parent

Company

Issuing

Subsidiary

Guarantor

Subsidiary

Non-Guarantor

Subsidiaries

Consolidating

and

Eliminating

Adjustments Consolidated

Revenues:

Service revenues ............... $ — $2,495,525 $ — $333,691 $ 65 $2,829,281

Equipment revenues ............ — 211,659 — 30,191 — 241,850

Other revenues ................. — 15,836 106,696 4,156 (126,688) —

Total revenues ............... — 2,723,020 106,696 368,038 (126,623) 3,071,131

Operating expenses:

Cost of service (exclusive of items

shown separately below) ....... — 999,371 — 92,332 (110,500) 981,203

Cost of equipment .............. — 716,461 — 101,459 — 817,920

Selling and marketing ........... — 316,228 — 53,029 — 369,257

General and administrative ....... 14,351 303,252 751 53,298 (16,123) 355,529

Depreciation and amortization .... — 494,967 — 53,459 — 548,426

Impairments and other charges .... — 1,206 377 25,187 — 26,770

Total operating expenses ....... 14,351 2,831,485 1,128 378,764 (126,623) 3,099,105

Gain (loss) on sale, exchange or

disposal of assets, net ........... — (12,947) 8,471 7,098 — 2,622

Operating income (loss) ......... (14,351) (121,412) 114,039 (3,628) — (25,352)

Equity in net income (loss) of

consolidated subsidiaries ......... (311,856) 90,147 — — 221,709 —

Equity in net income of investees,

net .......................... — 2,984 — — — 2,984

Interest income .................. 24,251 20,051 — 5 (44,062) 245

Interest expense .................. (12,671) (267,297) — (20,269) 44,062 (256,175)

Other loss, net ................... — (2) — — — (2)

Income (loss) before income

taxes ....................... (314,627) (275,529) 114,039 (23,892) 221,709 (278,300)

Income tax expense ............... — (39,377) — — — (39,377)

Net income (loss) ............... (314,627) (314,906) 114,039 (23,892) 221,709 (317,677)

Accretion of redeemable

non-controlling interests and

distributions, net of tax .......... — 3,050 — — — 3,050

Net income (loss) attributable to

common stockholders ........... $(314,627) $ (311,856) $114,039 $ (23,892) $ 221,709 $ (314,627)

135