Cricket Wireless 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

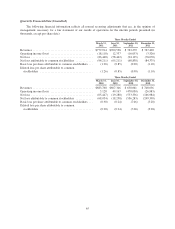

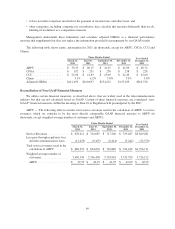

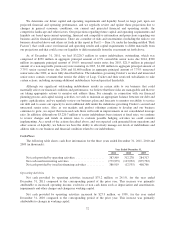

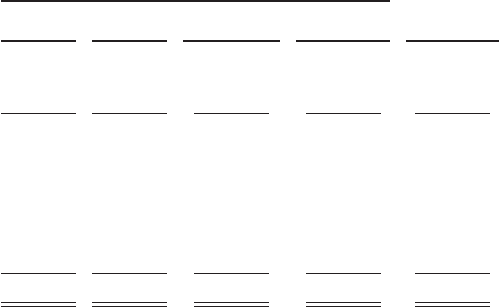

Adjusted OIBDA — The following table reconciles adjusted OIBDA to operating income (loss), which we

consider to be the most directly comparable GAAP financial measure to adjusted OIBDA (in thousands):

Three Months Ended Year Ended

December 31,

2011

March 31,

2011

June 30,

2011

September 30,

2011

December 31,

2011

Operating income (loss) ............ $(18,110) $ 12,337 $ (16,053) $ (3,526) $ (25,352)

Plus depreciation and

amortization ................. 126,674 136,137 144,904 140,711 548,426

OIBDA ......................... $108,564 $148,474 $128,851 $137,185 $523,074

Plus (gain) loss on sale, exchange or

disposal of assets, net .......... 349 4,646 678 (8,295) (2,622)

Plus impairments and other

charges ..................... — 631 23,693 2,446 26,770

Plus share-based compensation

expense ..................... 3,579 6,946 1,030 3,773 15,328

Adjusted OIBDA ................. $112,492 $160,697 $154,252 $135,109 $562,550

Liquidity and Capital Resources

Overview

Our principal sources of liquidity are our existing unrestricted cash, cash equivalents and short-term

investments and cash generated from operations. From time to time, we may also generate additional liquidity by

selling non-core assets or through future capital market transactions. We had a total of $751.0 million in

unrestricted cash, cash equivalents and short-term investments as of December 31, 2011. We generated $387.5

million of net cash from operating activities during the year ended December 31, 2011, and we expect that cash

from operations will continue to be a significant and increasing source of liquidity as our markets and product

offerings continue to develop and our business continues to grow. We believe that our existing unrestricted cash,

cash equivalents and short term investments, together with cash generated from operations, provide us with

sufficient liquidity to meet the future operating and capital requirements for our current business operations, as

well as our current business investment initiatives.

Our current business investment initiatives include our plan to deploy next-generation LTE network

technology across approximately two-thirds of our current network footprint over the next two to three years. We

successfully launched a commercial trial market in late 2011 and plan to cover up to approximately 25 million

POPs with LTE in 2012. Other current business investment initiatives include the ongoing maintenance and

development of our network and other business assets to allow us to continue to provide customers with high-

quality service. In addition, we plan to continue to strengthen and expand our distribution, including through the

wholesale agreement we have entered into, which we use to offer Cricket services in nationwide retailers outside

of our current network footprint. For our estimate of total capital expenditures for fiscal 2012, and projected

capital expenditures for these current business investment initiatives over the next several years, see the

discussion below under “— Capital Expenditures, Significant Acquisitions and Other Transactions.”

We may also pursue other activities to build our business, which could be significant. As we continue to

expand the size and scope of our business, we may enter into agreements with other vendors that contain

significant purchase or revenue commitments to enable us to obtain more favorable overall terms and conditions

for attractive products and services. Other business investment initiatives could include the launch of additional

new product and service offerings, the acquisition of additional spectrum through private transactions or FCC

auctions, the build-out and launch of new markets, entering into partnerships with others or the acquisition of all

or portions of other wireless communications companies or complementary businesses. We do not intend to

pursue any of these other business investment initiatives at a significant level unless we believe we have

sufficient liquidity to support the operating and capital requirements for our current business operations, our

current business investment initiatives and any such other activities.

71