Cricket Wireless 2011 Annual Report Download - page 92

Download and view the complete annual report

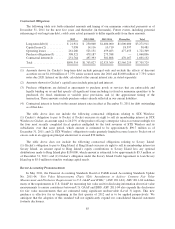

Please find page 92 of the 2011 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, in the event we are involved in a change-of-control transaction with another facilities-based

wireless carrier with annual revenues of at least $500 million in the fiscal year preceding the date of the change

of control agreement (other than MetroPCS), either we (or our successor in interest) or Sprint may terminate the

wholesale agreement within 60 days following the closing of such a transaction. In connection with any such

termination, we (or our successor in interest) would be required to pay to Sprint a specified percentage of the

remaining aggregate minimum revenue commitment, with the percentage to be paid depending on the year in

which the change of control agreement was entered into, beginning at 40% for any such agreement entered into

in 2011, 30% for any such agreement entered into in 2012, 20% for any such agreement entered into in 2013 and

10% for any such agreement entered into in 2014 or 2015.

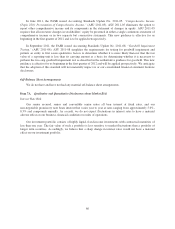

In the event that we are involved in a change-of-control transaction with MetroPCS during the term of the

wholesale agreement, then the agreement would continue in full force and effect, subject to certain revisions,

including, without limitation, an increase to the total minimum revenue commitment to $350 million, taking into

account any revenue contributed by Cricket prior to the date thereof. In the event Sprint is involved in a

change-of-control transaction, the agreement would bind Sprint’s successor-in-interest.

STX Wireless Joint Venture

Cricket service is offered in South Texas by our joint venture STX Operations. Cricket controls STX

Operations through a 75.75% controlling membership interest in its parent company, STX Wireless. On

October 1, 2010, we and Pocket contributed substantially all of our respective wireless spectrum and operating

assets in the South Texas region to STX Wireless to create a joint venture to provide Cricket service in the South

Texas region. In exchange for such contributions, Cricket received a 75.75% controlling membership interest in

STX Wireless and Pocket received a 24.25% non-controlling membership interest. Additionally, in connection

with the transaction, we made payments to Pocket of approximately $40.7 million in cash.

The joint venture strengthens our presence and competitive positioning in the South Texas region.

Commencing October 1, 2010, STX Operations began providing Cricket service to approximately 700,000

customers, of which approximately 323,000 were contributed by Pocket, with a network footprint covering

approximately 4.4 million POPs.

The joint venture is controlled and managed by Cricket under the terms of the amended and restated limited

liability company agreement of STX Wireless, or the STX LLC Agreement. Under the STX LLC Agreement,

Pocket has the right to put, and we have the right to call, all of Pocket’s membership interests in STX Wireless,

which rights are generally exercisable on or after April 1, 2014. In addition, in the event of a change of control of

Leap, Pocket is obligated to sell to us all of its membership interests in STX Wireless. The purchase price for

Pocket’s membership interests would be equal to 24.25% of the product of Leap’s enterprise value-to-revenue

multiple for the four most recently completed fiscal quarters multiplied by the total revenues of STX Wireless

and its subsidiaries over that same period. The purchase price is payable in either cash, Leap common stock or a

combination thereof, as determined by Cricket in its discretion (provided that, if permitted by Cricket’s debt

instruments, at least $25 million of the purchase price must be paid in cash). We have the right to deduct from or

set off against the purchase price certain distributions made to Pocket, as well as any obligations owed to us by

Pocket. Under the STX LLC Agreement, Cricket is permitted to purchase Pocket’s membership interests in STX

Wireless over multiple closings in the event that the block of shares of Leap common stock issuable to Pocket at

the closing of the purchase would be greater than 9.9% of the total number of shares of Leap common stock then

issued and outstanding. To the extent the redemption price for Pocket’s non-controlling membership interest

varies from the value of Pocket’s net interest in STX Wireless at any period (after the attribution of profits or

losses), the value of such interest is accreted to the redemption price for such interest with a corresponding

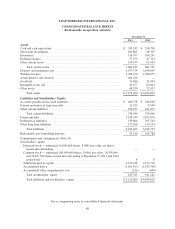

adjustment to additional paid-in capital. For the years ended December 31, 2011 and December 31, 2010, we

recorded a net accretion benefit of $8.9 million and accretion charges of $48.1 million, respectively, to bring the

carrying value of Pocket’s membership interests in STX Wireless to its estimated redemption values of $90.7

million and $99.5 million, respectively. Additionally, and in accordance with the STX LLC Agreement, STX

Wireless made pro-rata distributions of $5.7 million and $1.7 million to Cricket and Pocket, respectively, with

82