Cisco 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The actual results experienced by the Company may differ materially from management’s estimates.

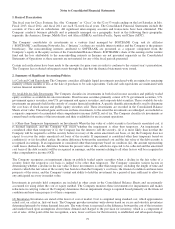

(w) New Accounting Updates Recently Adopted

In June 2011, the FASB issued an accounting standard update to provide guidance on increasing the prominence of items

reported in other comprehensive income, which eliminated the option to present components of other comprehensive income

as part of the statement of equity. The Company adopted this accounting standard in the first quarter of fiscal 2013.

In August 2011, the FASB approved a revised accounting standard update intended to simplify how an entity tests goodwill

for impairment. The amendment will allow an entity to first assess qualitative factors to determine whether it is necessary to

perform the two-step quantitative goodwill impairment test. An entity no longer will be required to calculate the fair value of a

reporting unit unless the entity determines, based on a qualitative assessment, that it is more likely than not that its fair value is

less than its carrying amount. This accounting standard update became effective for the Company beginning in the first quarter

of fiscal 2013, and its adoption did not have any impact on the Company’s Consolidated Financial Statements.

(x) Recent Accounting Standards or Updates Not Yet Effective

In December 2011, the FASB issued an accounting standard update requiring enhanced disclosures about certain financial

instruments and derivative instruments that are offset in the statement of financial position or that are subject to enforceable

master netting arrangements or similar agreements. This accounting standard update will be effective for the Company

beginning in the first quarter of fiscal 2014, at which time the Company will include the required disclosures.

In July 2012, the FASB issued an accounting standard update intended to simplify how an entity tests indefinite-lived

intangible assets other than goodwill for impairment by providing entities with an option to perform a qualitative assessment to

determine whether further impairment testing is necessary. This accounting standard update will be effective for the Company

beginning in the first quarter of fiscal 2014. The adoption of this accounting standard update did not have any impact on the

Company’s Consolidated Financial Statements.

In February 2013, the FASB issued an accounting standard update to require reclassification adjustments from other

comprehensive income to be presented either in the financial statements or in the notes to the financial statements. This

accounting standard update will be effective for the Company beginning in the first quarter of fiscal 2014, at which time the

Company will include the required disclosures.

In March 2013, the FASB issued an accounting standard update requiring an entity to release into net income the entire

amount of a cumulative translation adjustment related to its investment in a foreign entity when as a parent it either sells a part

or all of its investment in the foreign entity or no longer holds a controlling financial interest in a subsidiary or group of assets

within the foreign entity. This accounting standard update will be effective for the Company beginning in the first quarter of

fiscal 2015. The Company is currently evaluating the impact of this accounting standard update on its Consolidated Financial

Statements.

In July 2013, the FASB issued an accounting standard update that provides explicit guidance on the financial statement

presentation of an unrecognized tax benefit when a net operating loss carryforward or a tax credit carryforward exists. Under

the new standard update, the Company’s unrecognized tax benefit, or a portion of an unrecognized tax benefit, should be

presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward or a tax credit

carryforward. This accounting standard update will be effective for the Company beginning in the first quarter fiscal 2015 and

applied prospectively with early adoption permitted. The Company is currently evaluating the impact of this accounting

standard update on its Consolidated Financial Statements.

85