Cisco 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LIQUIDITY AND CAPITAL RESOURCES

The following sections discuss the effects of changes in our balance sheet, our capital allocation strategy including stock

repurchase program and dividends, our contractual obligations, and certain other commitments and activities on our liquidity

and capital resources.

Balance Sheet and Cash Flows

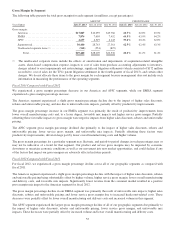

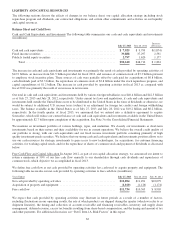

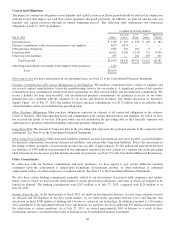

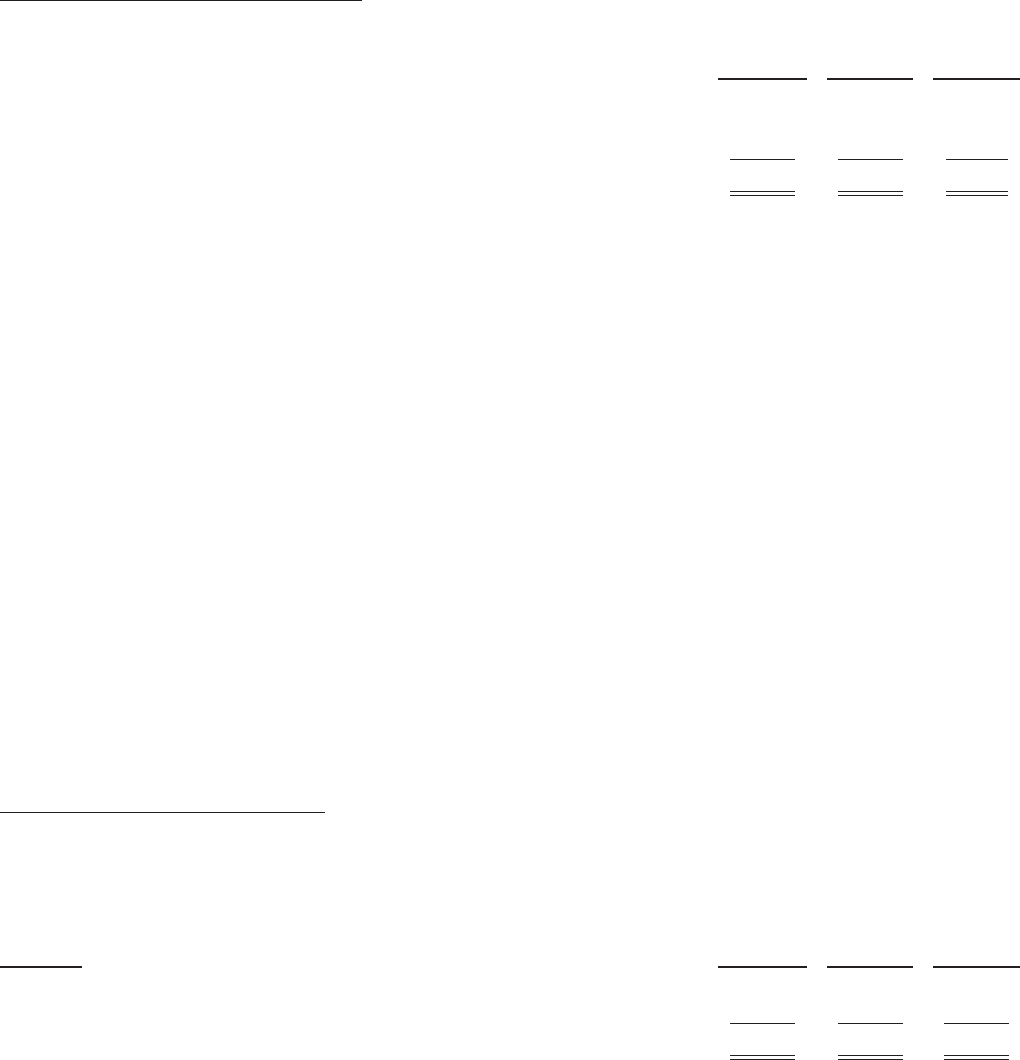

Cash and Cash Equivalents and Investments The following table summarizes our cash and cash equivalents and investments

(in millions):

July 27, 2013 July 28, 2012

Increase

(Decrease)

Cash and cash equivalents ................................................ $ 7,925 $ 9,799 $(1,874)

Fixed income securities .................................................. 39,888 37,297 2,591

Publicly traded equity securities ........................................... 2,797 1,620 1,177

Total ............................................................. $50,610 $48,716 $ 1,894

The increase in cash and cash equivalents and investments was primarily the result of cash provided by operating activities of

$12.9 billion, an increase from $11.5 billion provided for fiscal 2012, and issuance of common stock of $3.3 billion pursuant

to employee stock incentive plans. These sources of cash were partially offset by cash paid for acquisitions of $6.8 billion,

cash dividends paid of $3.3 billion, the repurchase of common stock of $2.8 billion under the stock repurchase program, and

capital expenditures of $1.2 billion. The increase in cash provided by operating activities in fiscal 2013 as compared with

fiscal 2012 was primarily the result of an increase in net income.

Our total in cash and cash equivalents and investments held by various foreign subsidiaries was $40.4 billion and $42.5 billion

as of July 27, 2013 and July 28, 2012, respectively. Under current tax laws and regulations, if cash and cash equivalents and

investments held outside the United States were to be distributed to the United States in the form of dividends or otherwise, we

would be subject to additional U.S. income taxes (subject to an adjustment for foreign tax credits) and foreign withholding

taxes. The balance available in the United States as of July 27, 2013 and July 28, 2012 was $10.2 billion and $6.2 billion,

respectively. In the fourth quarter of fiscal 2013, we announced that we entered into a definitive agreement to acquire

Sourcefire, which will reduce our current balance of cash and cash equivalents and investments available in the United States

by approximately $2.7 billion upon completion of the acquisition. See Note 3 to the Consolidated Financial Statements.

We maintain an investment portfolio of various holdings, types, and maturities. We classify our investments as short-term

investments based on their nature and their availability for use in current operations. We believe the overall credit quality of

our portfolio is strong, with our cash equivalents and our fixed income investment portfolio consisting primarily of high

quality investment-grade securities. We believe that our strong cash and cash equivalents and investments position allows us to

use our cash resources for strategic investments to gain access to new technologies, for acquisitions, for customer financing

activities, for working capital needs, and for the repurchase of shares of common stock and payment of dividends as discussed

below.

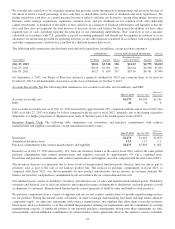

Free Cash Flow and Capital Allocation In August 2012, as part of our capital allocation strategy, we announced our intent to

return a minimum of 50% of our free cash flow annually to our shareholders through cash dividends and repurchases of

common stock, which objective we accomplished in fiscal 2013.

We define free cash flow as net cash provided by operating activities less cash used to acquire property and equipment. The

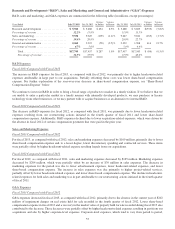

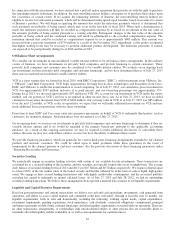

following table reconciles our net cash provided by operating activities to free cash flow (in millions):

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

Net cash provided by operating activities .................................... $12,894 $11,491 $10,079

Acquisition of property and equipment ...................................... (1,160) (1,126) (1,174)

Free cash flow ......................................................... $11,734 $10,365 $ 8,905

We expect that cash provided by operating activities may fluctuate in future periods as a result of a number of factors,

including fluctuations in our operating results, the rate at which products are shipped during the quarter (which we refer to as

shipment linearity), the timing and collection of accounts receivable and financing receivables, inventory and supply chain

management, deferred revenue, excess tax benefits resulting from share-based compensation, and the timing and amount of tax

and other payments. For additional discussion, see “Part I, Item 1A. Risk Factors” in this report.

62