Cisco 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

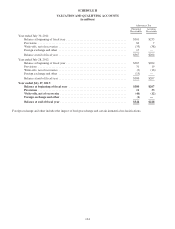

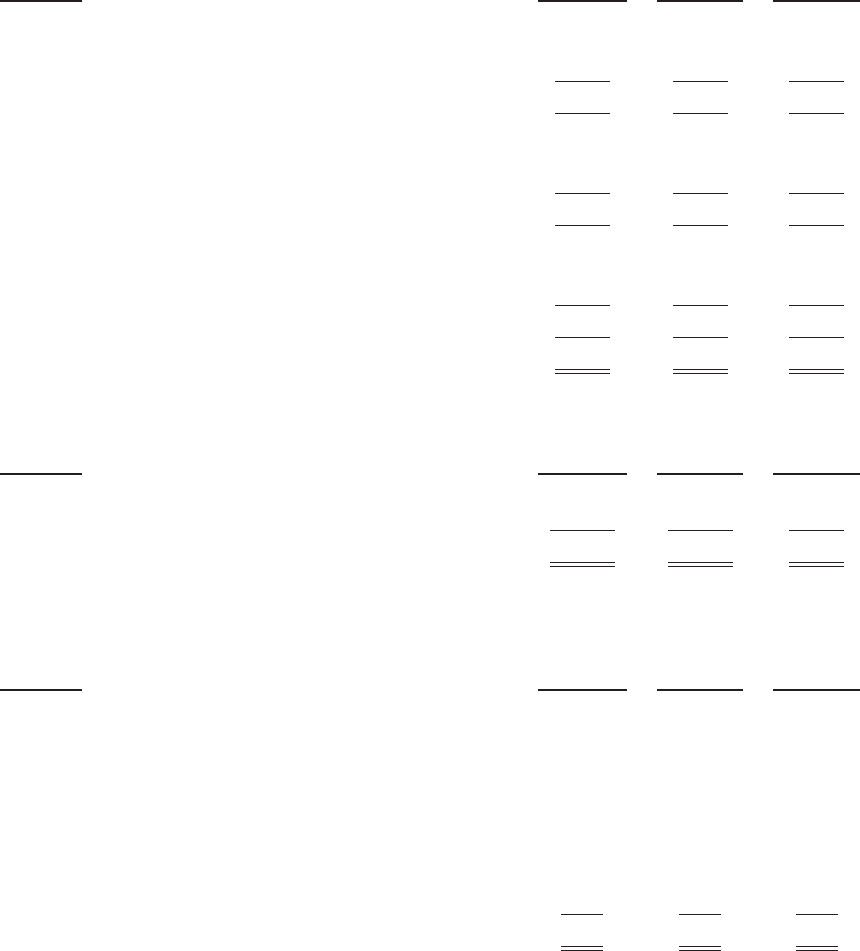

15. Income Taxes

(a) Provision for Income Taxes

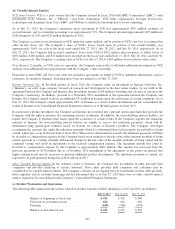

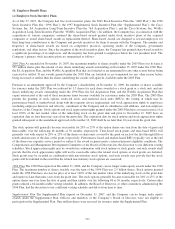

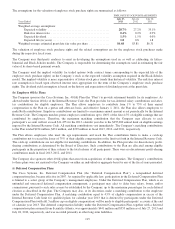

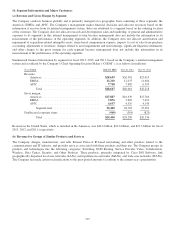

The provision for income taxes consists of the following (in millions):

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

Federal:

Current ........................................ $ 601 $1,836 $ 914

Deferred ....................................... 152 (270) (168)

753 1,566 746

State:

Current ........................................ 81 119 49

Deferred ....................................... 48 (53) 83

129 66 132

Foreign:

Current ........................................ 599 477 529

Deferred ....................................... (237) 9 (72)

362 486 457

Total ...................................... $1,244 $2,118 $1,335

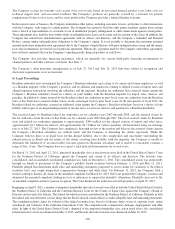

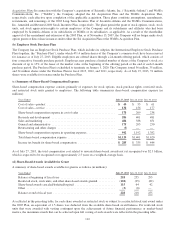

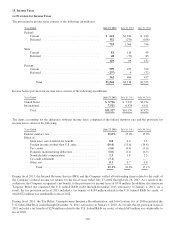

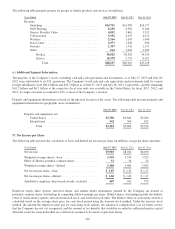

Income before provision for income taxes consists of the following (in millions):

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

United States ........................................ $ 3,716 $ 3,235 $1,214

International ........................................ 7,511 6,924 6,611

Total .......................................... $11,227 $10,159 $7,825

The items accounting for the difference between income taxes computed at the federal statutory rate and the provision for

income taxes consist of the following:

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

Federal statutory rate ................................. 35.0% 35.0% 35.0%

Effect of:

State taxes, net of federal tax benefit ................. 0.8 0.4 1.5

Foreign income at other than U.S. rates ............... (16.4) (15.6) (19.4)

Tax credits ..................................... (1.6) (0.4) (3.0)

Domestic manufacturing deduction .................. (1.0) (1.1) (0.3)

Nondeductible compensation ....................... 1.3 1.8 2.5

Tax audit settlement .............................. (7.1) ——

Other, net ...................................... 0.1 0.7 0.8

Total ...................................... 11.1% 20.8% 17.1%

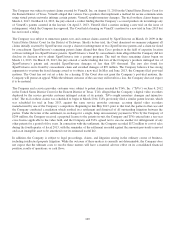

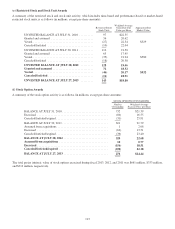

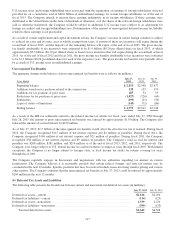

During fiscal 2013, the Internal Revenue Service (IRS) and the Company settled all outstanding items related to the audit of

the Company’s federal income tax returns for the fiscal years ended July 27, 2002 through July 28, 2007. As a result of the

settlement, the Company recognized a net benefit to the provision for income taxes of $794 million. In addition, the American

Taxpayer Relief Act reinstated the U.S. federal R&D credit through December 2013, retroactive to January 1, 2012. As a

result, the tax provision in fiscal 2013 included a tax benefit of $184 million related to the U.S. federal R&D tax credit, of

which $72 million was attributable to fiscal 2012.

During fiscal 2011, the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 reinstated the

U.S. federal R&D tax credit through December 31, 2011, retroactive to January 1, 2010. As a result, the tax provision in fiscal

2011 included a tax benefit of $234 million related to the U.S. federal R&D tax credit, of which $65 million was attributable to

fiscal 2010.

116