Cisco 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This Annual Report on Form 10-K, including this Management’s Discussion and Analysis of Financial Condition and Results

of Operations, contains forward-looking statements regarding future events and our future results that are subject to the safe

harbors created under the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the

“Exchange Act”). All statements other than statements of historical facts are statements that could be deemed forward-looking

statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in

which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,”

“goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations

of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements

that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other

characterizations of future events or circumstances are forward-looking statements. Readers are cautioned that these forward-

looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict,

including those identified below, under “Part I, Item 1A. Risk Factors,” and elsewhere herein. Therefore, actual results may

differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise

or update any forward-looking statements for any reason.

OVERVIEW

We design, manufacture, and sell Internet Protocol (IP) based networking and other products related to the communications

and information technology (IT) industry and provide services associated with these products and their use. We provide a

broad line of products for transporting data, voice, and video within buildings, across campuses, and around the world. Our

products are designed to transform how people connect, communicate, and collaborate. Our products are utilized at enterprise

businesses, public institutions, telecommunications companies and other service providers, commercial businesses, and

personal residences.

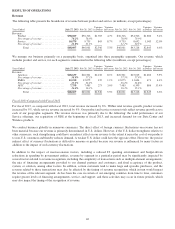

A summary of our results is as follows (in millions, except percentages and per-share amounts):

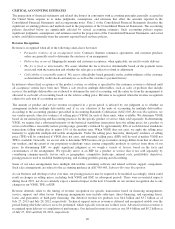

Three Months Ended Fiscal Year Ended

July 27,

2013

July 28,

2012 Variance

July 27,

2013

July 28,

2012 Variance

Revenue ......................................... $12,417 $11,690 6.2% $48,607 $46,061 5.5%

Gross margin percentage ............................ 59.2% 60.6% (1.4)pts 60.6% 61.2% (0.6)pts

Research and development .......................... $ 1,517 $ 1,416 7.1% $ 5,942 $ 5,488 8.3%

Sales and marketing ............................... $ 2,360 $ 2,417 (2.4)% $ 9,538 $ 9,647 (1.1)%

General and administrative .......................... $ 590 $ 711 (17.0)% $ 2,264 $ 2,322 (2.5)%

Total R&D, sales and marketing, general and

administrative .................................. $ 4,467 $ 4,544 (1.7)% $17,744 $17,457 1.6%

Total as a percentage of revenue ...................... 36.0% 38.9% (2.9)pts 36.5% 37.9% (1.4)pts

Amortization of purchased intangible assets ............ $66$ 91 (27.5)% $ 395 $ 383 3.1%

Restructuring and other charges ...................... $— $ 79 (100.0)% $ 105 $ 304 (65.5)%

Operating income as a percentage of revenue ........... 22.7% 20.3% 2.4pts 23.0% 21.9% 1.1pts

Income tax percentage ............................. 20.9% 19.7% 1.2pts 11.1% 20.8% (9.7)pts

Net income ...................................... $ 2,270 $ 1,917 18.4% $ 9,983 $ 8,041 24.2%

Net income as a percentage of revenue ................. 18.3% 16.4% 1.9pts 20.5% 17.5% 3.0pts

Earnings per share—diluted ......................... $ 0.42 $ 0.36 16.7% $ 1.86 $ 1.49 24.8%

37