Cisco 2013 Annual Report Download - page 75

Download and view the complete annual report

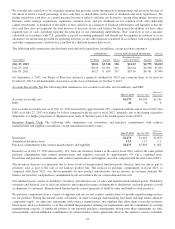

Please find page 75 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with this investment, we have entered into a put/call option agreement that provides us with the right to purchase

the remaining interests in Insieme. In addition, the noncontrolling interest holders can require us to purchase their shares upon

the occurrence of certain events. If we acquire the remaining interests of Insieme, the noncontrolling interest holders are

eligible to receive two milestone payments, which will be determined using agreed-upon formulas based on revenue for certain

of Insieme’s products. We will begin recognizing the amounts due under the milestone payments when it is determined that

such payments are probable of being earned, which may occur in the first half of fiscal 2014. When such a determination is

made, the milestone payments will then be recorded as compensation expense by us based on an estimate of the fair value of

the amounts probable of being earned, pursuant to a vesting schedule. Subsequent changes to the fair value of the amounts

probable of being earned and the continued vesting will result in adjustments to the recorded compensation expense. The

maximum amount that could be recorded as compensation expense by us is approximately $863 million. This amount was

increased from a previous maximum of $750 million as a result of the November 2012 amendment, as the parties recognized

that higher staffing levels may be necessary to perform additional product development. The milestone payments, if earned,

are expected to be paid primarily during fiscal 2016 and fiscal 2017.

Off-Balance Sheet Arrangements

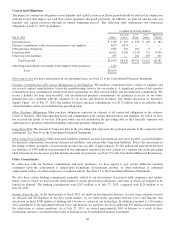

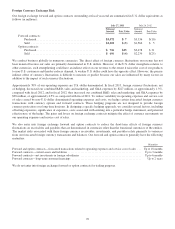

We consider our investments in unconsolidated variable interest entities to be off-balance sheet arrangements. In the ordinary

course of business, we have investments in privately held companies and provide financing to certain customers. These

privately held companies and customers may be considered to be variable interest entities. We evaluate on an ongoing basis

our investments in these privately held companies and customer financings, and we have determined that as of July 27, 2013

there were no material unconsolidated variable interest entities.

VCE is a joint venture that we formed in fiscal 2010 with EMC Corporation (“EMC”), with investments from VMware, Inc.

(“VMware”) and Intel Corporation. VCE helps organizations leverage best-in-class technologies and disciplines from Cisco,

EMC, and VMware to enable the transformation to cloud computing. As of July 27, 2013, our cumulative gross investment in

VCE was approximately $507 million, inclusive of accrued interest, and our ownership percentage was approximately 35%.

During fiscal 2013, we invested approximately $93 million in VCE. We account for our investment in VCE under the equity

method, and our portion of VCE’s net loss is recognized in other income (loss), net. As of July 27, 2013, we have recorded

cumulative losses since inceptions from VCE of $422 million. Our carrying value in VCE as of July 27, 2013 was $85 million.

Over the next 12 months, as VCE scales its operations, we expect that we will make additional investments in VCE and may

incur additional losses proportionate with our share ownership.

From time to time, EMC and Cisco may enter into guarantee agreements on behalf of VCE to indemnify third parties, such as

customers, for monetary damages. Such guarantees were not material as of July 27, 2013.

On an ongoing basis, we reassess our investments in privately held companies and customer financings to determine if they are

variable interest entities and if we would be regarded as the primary beneficiary pursuant to the applicable accounting

guidance. As a result of this ongoing assessment, we may be required to make additional disclosures or consolidate these

entities. Because we may not control these entities, we may not have the ability to influence these events.

We provide financing guarantees, which are generally for various third-party financing arrangements extended to our channel

partners and end-user customers. We could be called upon to make payments under these guarantees in the event of

nonpayment by the channel partners or end-user customers. See the previous discussion of these financing guarantees under

“Financing Receivables and Guarantees.”

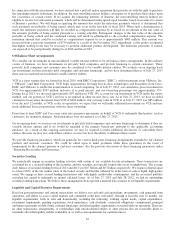

Securities Lending

We periodically engage in securities lending activities with certain of our available-for-sale investments. These transactions are

accounted for as a secured lending of the securities, and the securities are typically loaned only on an overnight basis. The average

daily balance of securities lending for fiscal 2013 and 2012 was $0.7 billion and $0.5 billion, respectively. We require collateral equal

to at least 102% of the fair market value of the loaned security and that the collateral be in the form of cash or liquid, high-quality

assets. We engage in these secured lending transactions only with highly creditworthy counterparties, and the associated portfolio

custodian has agreed to indemnify us against collateral losses. As of July 27, 2013 and July 28, 2012, we had no outstanding

securities lending transactions. We believe these arrangements do not present a material risk or impact to our liquidity requirements.

Liquidity and Capital Resource Requirements

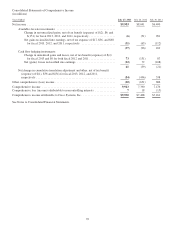

Based on past performance and current expectations, we believe our cash and cash equivalents, investments, cash generated from

operations, and ability to access capital markets and committed credit lines will satisfy, through at least the next 12 months, our

liquidity requirements, both in total and domestically, including the following: working capital needs, capital expenditures,

investment requirements, pending acquisitions, stock repurchases, cash dividends, contractual obligations, commitments, principal

and interest payments on debt, future customer financings, and other liquidity requirements associated with our operations. There are

no other transactions, arrangements, or relationships with unconsolidated entities or other persons that are reasonably likely to

materially affect the liquidity and the availability of, as well as our requirements for capital resources.

67