Cisco 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

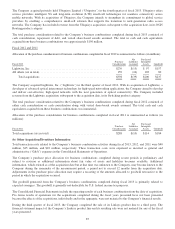

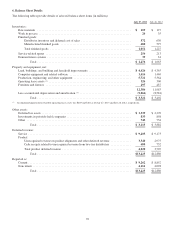

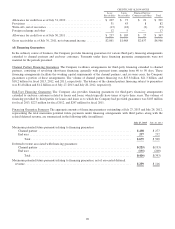

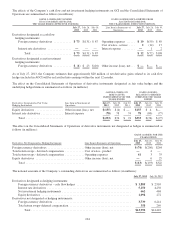

8. Investments

(a) Summary of Available-for-Sale Investments

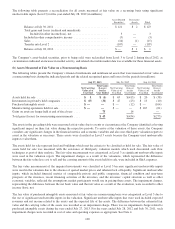

The following tables summarize the Company’s available-for-sale investments (in millions):

July 27, 2013

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Fixed income securities:

U.S. government securities ........................... $27,814 $ 22 $(13) $27,823

U.S. government agency securities ..................... 3,083 7 (1) 3,089

Non-U.S. government and agency securities ............. 1,094 3 (2) 1,095

Corporate debt securities ............................ 7,876 55 (50) 7,881

Total fixed income securities ...................... 39,867 87 (66) 39,888

Publicly traded equity securities ........................... 2,063 738 (4) 2,797

Total ...................................... $41,930 $825 $(70) $42,685

July 28, 2012

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Fixed income securities:

U.S. government securities ............................ $24,201 $ 41 $ (1) $24,241

U.S. government agency securities ...................... 5,367 21 — 5,388

Non-U.S. government and agency securities ............... 1,629 9 — 1,638

Corporate debt securities .............................. 5,959 74 (3) 6,030

Total fixed income securities ....................... 37,156 145 (4) 37,297

Publicly traded equity securities ............................ 1,107 524 (11) 1,620

Total ...................................... $38,263 $669 $ (15) $38,917

U.S. government agency securities include corporate debt securities that are guaranteed by the Federal Deposit Insurance

Corporation (FDIC), while non-U.S. government and agency securities include agency and corporate debt securities that are

guaranteed by non-U.S. governments.

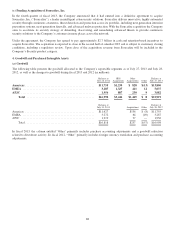

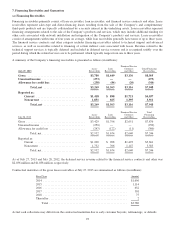

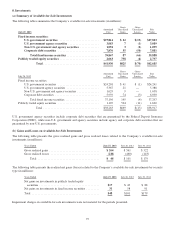

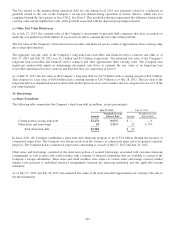

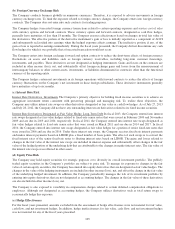

(b) Gains and Losses on Available-for-Sale Investments

The following table presents the gross realized gains and gross realized losses related to the Company’s available-for-sale

investments (in millions):

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

Gross realized gains .................................. $ 264 $ 561 $ 322

Gross realized losses ................................. (216) (460) (143)

Total .......................................... $48 $ 101 $ 179

The following table presents the realized net gains (losses) related to the Company’s available-for-sale investments by security

type (in millions):

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

Net gains on investments in publicly traded equity

securities ......................................... $17 $43 $88

Net gains on investments in fixed income securities ......... 31 58 91

Total .............................................. $48 $101 $179

Impairment charges on available-for-sale investments were not material for the periods presented.

97