Cisco 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

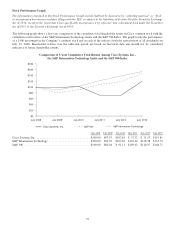

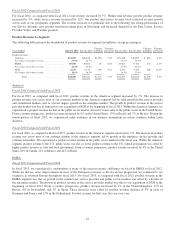

Fourth Quarter Snapshot

For the fourth quarter of fiscal 2013, as compared with the corresponding period in fiscal 2012, revenue increased by 6%, with

both product and service revenue increasing by 6%. With regard to our geographic segment performance, on a year-over-year

basis, revenue increased by 7% in the Americas, increased by 12% in EMEA, and decreased by 3% in APJC. Total gross

margin decreased by 1.4 percentage points, primarily as a result of the TiVo patent litigation settlement. As a percentage of

revenue, research and development, sales and marketing, and general and administrative expenses collectively declined by

2.9 percentage points, primarily due to lower general and administrative expenses. For the fourth quarter of fiscal 2012,

general and administrative expenses included $202 million of real estate charges, primarily related to impairment charges on

real estate held for sale. Operating income as a percentage of revenue increased by 2.4 percentage points, primarily as a result

of lower general and administrative expenses, lower restructuring and other charges, and also the impact of our revenue

increase. Diluted earnings per share increased by 17% from the prior year period, primarily as a result of an 18% increase in

net income.

Strategy and Focus Areas

Our focus continues to be on our five foundational priorities:

• Leadership in our core business (routing, switching, and associated services) which includes comprehensive security

and mobility solutions

• Collaboration

• Data center virtualization and cloud

• Video

• Architectures for business transformation

We believe that focusing on these priorities best positions us to continue to expand our share of our customers’ information

technology spending. For a full discussion of our strategy and focus areas, see Item 1. Business.

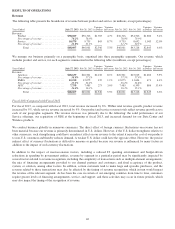

Other Key Financial Measures

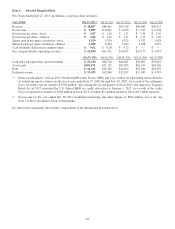

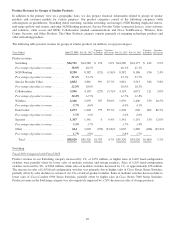

The following is a summary of our other key financial measures for fiscal 2013 compared with fiscal 2012 (in millions, except

days sales outstanding in accounts receivable (DSO) and annualized inventory turns):

Fiscal 2013 Fiscal 2012

Cash and cash equivalents and investments ................................................ $50,610 $48,716

Cash provided by operating activities ..................................................... $12,894 $11,491

Deferred revenue ..................................................................... $13,423 $12,880

Repurchases of common stock—stock repurchase program ................................... $ 2,773 $ 4,360

Dividends .......................................................................... $ 3,310 $ 1,501

DSO............................................................................... 40 days 34 days

Inventories ......................................................................... $ 1,476 $ 1,663

Annualized inventory turns ............................................................. 13.8 11.7

Our product backlog at the end of fiscal 2013 was $4.9 billion, or 10% of fiscal 2013 total revenue, compared with $5.0 billion

at the end of fiscal 2012, or 11% of fiscal 2012 total revenue.

39