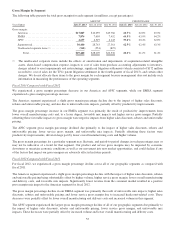

Cisco 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

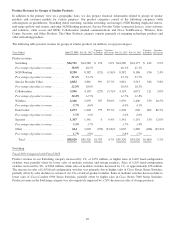

Fiscal 2012 Compared with Fiscal 2011

For fiscal 2012, as compared with fiscal 2011, total revenue increased by 7%. Within total revenue growth, product revenue

increased by 5%, while service revenue increased by 12%. Our product and service revenue totals reflected revenue growth

across each of our geographic segments. The revenue increase was primarily due to the following: the strong performance of

our Service offerings; new product transitions taking place in Switching; and increased demand for our Data Center, Service

Provider Video, and Wireless products.

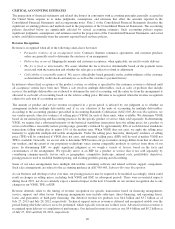

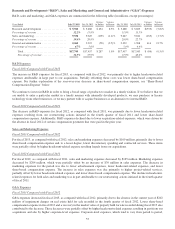

Product Revenue by Segment

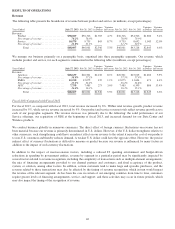

The following table presents the breakdown of product revenue by segment (in millions, except percentages):

Years Ended July 27, 2013 July 28, 2012

Variance

in Dollars

Variance

in Percent July 28, 2012 July 30, 2011

Variance

in Dollars

Variance

in Percent

Product revenue:

Americas .................................. $21,653 $20,168 $1,485 7.4% $20,168 $19,292 $ 876 4.5%

Percentage of product revenue ................. 57.0% 55.5% 55.5% 55.9%

EMEA .................................... 10,049 10,024 25 0.2% 10,024 9,788 236 2.4%

Percentage of product revenue ................. 26.4% 27.6% 27.6% 28.3%

APJC ..................................... 6,327 6,134 193 3.1% 6,134 5,446 688 12.6%

Percentage of product revenue ................. 16.6% 16.9% 16.9% 15.8%

Total ............................... $38,029 $36,326 $1,703 4.7% $36,326 $34,526 $1,800 5.2%

Americas

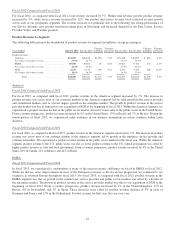

Fiscal 2013 Compared with Fiscal 2012

For fiscal 2013, as compared with fiscal 2012, product revenue in the Americas segment increased by 7%. The increase in

product revenue was across most of our customer markets in the Americas segment, led by solid growth in the service provider

and commercial markets and, to a lesser degree, growth in the enterprise market. The growth in product revenue in the service

provider market was due in large part to our acquisition of NDS at the beginning of fiscal 2013. Within the Americas segment, we

experienced a product revenue decline in the public sector market, driven by lower sales to the public sector in the United States.

From a country perspective, product revenue increased by 9% in the United States, 13% in Brazil, and 7% in Mexico. During the

fourth quarter of fiscal 2013, we experienced some weakness in our business momentum in certain countries within Latin

America.

Fiscal 2012 Compared with Fiscal 2011

For fiscal 2012, as compared with fiscal 2011, product revenue in the Americas segment increased by 5%. The increase in product

revenue was across most of our customer markets in the Americas segment, led by growth in the enterprise, service provider and

commercial markets. We experienced a product revenue decline in the public sector market for the fiscal year. Within the Americas

segment, product revenue to the U.S. public sector was flat, as lower product revenue to the U.S. federal government was offset by

higher product revenue to state and local government. From a country perspective, product revenue increased by 4% in the United

States, 10% in Canada, 21% in Mexico, and 14% in Brazil.

EMEA

Fiscal 2013 Compared with Fiscal 2012

In fiscal 2013, we experienced a continuation of many of the macroeconomic challenges we faced in EMEA in fiscal 2012.

While we did see some improvements in most of the European economy as the fiscal year progressed, we continued to see

weakness in southern Europe throughout fiscal 2013. For fiscal 2013, as compared with fiscal 2012, product revenue in the

EMEA segment was flat, as growth in the commercial, service provider and public sector markets was offset by a decline in

the enterprise market. The growth in product revenue in the service provider market was due to our acquisition of NDS at the

beginning of fiscal 2013. From a country perspective, product revenue increased by 1% in the United Kingdom, 11% in

Russia, 4% in Switzerland, and 3% in Spain. These increases were offset by product revenue declines of 3% in each of

Germany and France and 13% in the Netherlands. Product revenue for Italy was flat year over year.

47