Cisco 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

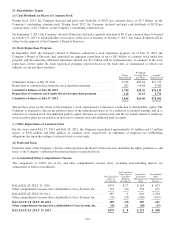

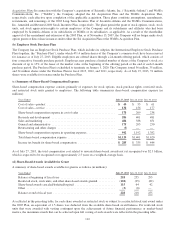

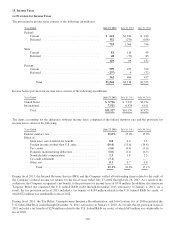

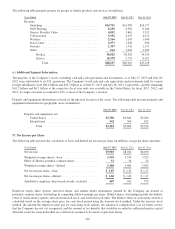

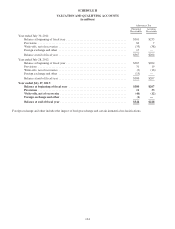

The components of the deferred tax assets and liabilities are as follows (in millions):

July 27, 2013 July 28, 2012

ASSETS

Allowance for doubtful accounts and returns ............................................ $ 390 $ 433

Sales-type and direct-financing leases .................................................. 167 162

Inventory write-downs and capitalization ............................................... 216 127

Investment provisions .............................................................. 214 261

IPR&D, goodwill, and purchased intangible assets ....................................... 123 119

Deferred revenue .................................................................. 1,624 1,618

Credits and net operating loss carryforwards ............................................ 681 721

Share-based compensation expense .................................................... 783 1,059

Accrued compensation .............................................................. 486 481

Other ........................................................................... 560 583

Gross deferred tax assets ........................................................ 5,244 5,564

Valuation allowance ........................................................... (98) (60)

Total deferred tax assets ........................................................ 5,146 5,504

LIABILITIES

Purchased intangible assets .......................................................... (1,101) (809)

Depreciation ...................................................................... (169) (131)

Unrealized gains on investments ...................................................... (211) (222)

Other ........................................................................... (23) (34)

Total deferred tax liabilities ...................................................... (1,504) (1,196)

Total net deferred tax assets ................................................. $ 3,642 $ 4,308

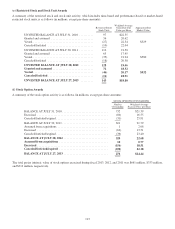

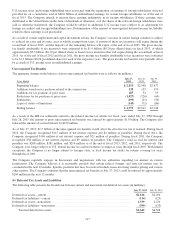

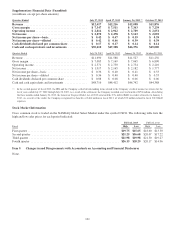

As of July 27, 2013, the Company’s federal, state, and foreign net operating loss carryforwards for income tax purposes were

$259 million, $1.0 billion, and $357 million, respectively. A significant amount of the federal net operating loss carryforwards

relates to acquisitions and, as a result, is limited in the amount that can be recognized in any one year. If not utilized, the

federal net operating loss will begin to expire in fiscal 2018, and the foreign and state net operating loss carryforwards will

begin to expire in fiscal 2014. The Company has provided a valuation allowance of $79 million for deferred tax assets related

to foreign net operating losses that are not expected to be realized.

As of July 27, 2013, the Company’s federal, state, and foreign tax credit carryforwards for income tax purposes were

approximately $7 million, $640 million, and $13 million, respectively. The federal and foreign tax credit carryforwards will

begin to expire in fiscal 2014 and 2027, respectively. The majority of state tax credits can be carried forward indefinitely;

however, the Company has provided a valuation allowance of $19 million for deferred tax assets related to state tax credits

that are not expected to be realized.

118