Cisco 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

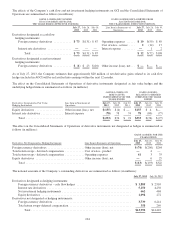

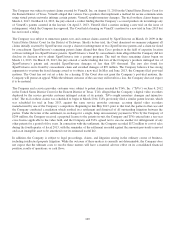

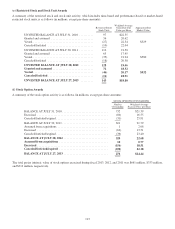

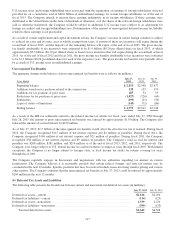

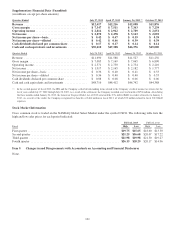

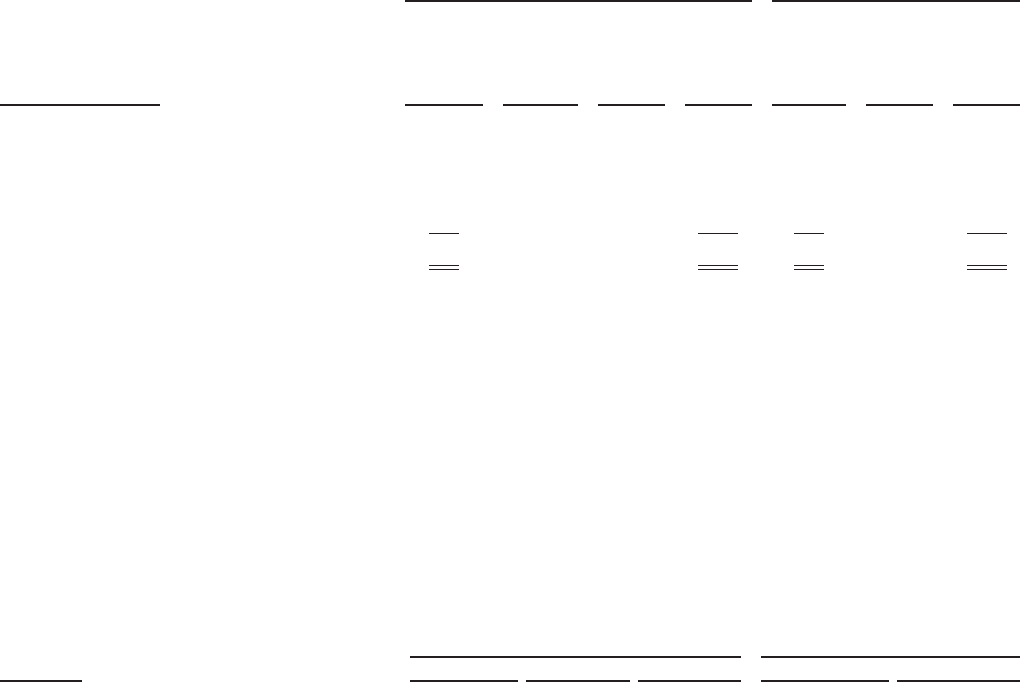

The following table summarizes significant ranges of outstanding and exercisable stock options as of July 27, 2013 (in

millions, except years and share prices):

STOCK OPTIONS OUTSTANDING STOCK OPTIONS EXERCISABLE

Range of Exercise Prices

Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life

(in Years)

Weighted-

Average

Exercise

Price per

Share

Aggregate

Intrinsic

Value

Number

Exercisable

Weighted-

Average

Exercise

Price per

Share

Aggregate

Intrinsic

Value

$ 0.01 – 15.00 ......................... 9 6.18 $ 3.99 $198 5 $ 7.00 $ 84

15.01 – 18.00 ......................... 40 1.20 17.79 308 40 17.79 307

18.01 – 20.00 ......................... 25 0.68 19.15 155 24 19.15 155

20.01 – 25.00 ......................... 86 2.22 22.82 231 86 22.82 231

25.01 – 35.00 ......................... 116 3.12 30.69 — 116 30.69 —

Total .............................. 276 2.45 $24.44 $892 271 $24.84 $777

The aggregate intrinsic value in the preceding table represents the total pretax intrinsic value, based on the Company’s closing

stock price of $25.50 as of July 26, 2013, that would have been received by the option holders had those option holders

exercised their stock options as of that date. The total number of in-the-money stock options exercisable as of July 27, 2013

was 155 million. As of July 28, 2012, 512 million outstanding stock options were exercisable and the weighted-average

exercise price was $22.65.

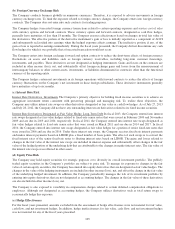

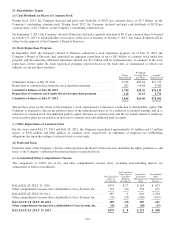

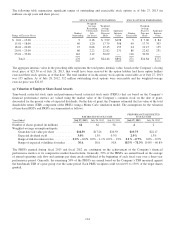

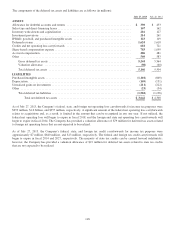

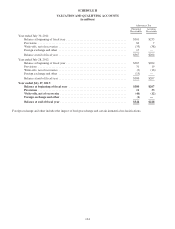

(g) Valuation of Employee Share-Based Awards

Time-based restricted stock units and performance-based restricted stock units (PRSUs) that are based on the Company’s

financial performance metrics are valued using the market value of the Company’s common stock on the date of grant,

discounted for the present value of expected dividends. On the date of grant, the Company estimated the fair value of the total

shareholder return (TSR) component of the PRSUs using a Monte Carlo simulation model. The assumptions for the valuation

of time-based RSUs and PRSUs are summarized as follows:

RESTRICTED STOCK UNITS

PERFORMANCE RESTRICTED

STOCK UNITS

Years Ended July 27, 2013 July 28, 2012 July 30, 2011 July 27, 2013 July 28, 2012

Number of shares granted (in millions) ........ 64 62 54 42

Weighted-average assumptions/inputs:

Grant date fair value per share ........... $18.39 $17.26 $20.59 $19.73 $22.17

Expected dividend yield ................ 3.0% 1.5% 0.3% 2.9% 1.3%

Range of risk-free interest rates ............ 0.0% – 1.1% 0.0% – 1.1% 0.0% – 1.9% 0.1% – 0.7% 0.0% – 0.9%

Range of expected volatilities for index .... N/A N/A N/A 18.3% – 78.3% 19.8% – 60.8%

The PRSUs granted during fiscal 2013 and fiscal 2012 are contingent on the achievement of the Company’s financial

performance metrics or its comparative market-based returns. Generally, 50% of the PRSUs are earned based on the average

of annual operating cash flow and earnings per share goals established at the beginning of each fiscal year over a three-year

performance period. Generally, the remaining 50% of the PRSUs are earned based on the Company’s TSR measured against

the benchmark TSR of a peer group over the same period. Each PRSU recipient could vest in 0% to 150% of the target shares

granted.

114