Cisco 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acquisition Plans In connection with the Company’s acquisitions of Scientific-Atlanta, Inc. (“Scientific-Atlanta”) and WebEx

Communications, Inc. (“WebEx”), the Company adopted the SA Acquisition Plan and the WebEx Acquisition Plan,

respectively, each effective upon completion of the applicable acquisition. These plans constitute assumptions, amendments,

restatements, and renamings of the 2003 Long-Term Incentive Plan of Scientific-Atlanta and the WebEx Communications,

Inc. Amended and Restated 2000 Stock Incentive Plan, respectively. The plans permit the grant of stock options, stock, stock

units, and stock appreciation rights to certain employees of the Company and its subsidiaries and affiliates who had been

employed by Scientific-Atlanta or its subsidiaries or WebEx or its subsidiaries, as applicable. As a result of the shareholder

approval of the amendment and extension of the 2005 Plan, as of November 15, 2007, the Company will no longer make stock

option grants or direct share issuances under either the SA Acquisition Plan or the WebEx Acquisition Plan.

(b) Employee Stock Purchase Plan

The Company has an Employee Stock Purchase Plan, which includes its subplan, the International Employee Stock Purchase

Plan (together, the “Purchase Plan”), under which 471.4 million shares of the Company’s common stock have been reserved

for issuance as of July 27, 2013. Eligible employees are offered shares through a 24-month offering period, which consists of

four consecutive 6-month purchase periods. Employees may purchase a limited number of shares of the Company’s stock at a

discount of up to 15% of the lesser of the market value at the beginning of the offering period or the end of each 6-month

purchase period. The Purchase Plan is scheduled to terminate on January 3, 2020. The Company issued 36 million, 35 million,

and 34 million shares under the Purchase Plan in fiscal 2013, 2012, and 2011, respectively. As of July 27, 2013, 51 million

shares were available for issuance under the Purchase Plan.

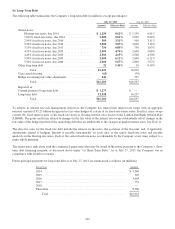

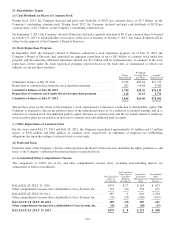

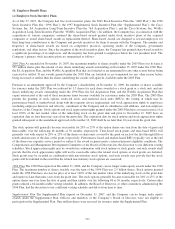

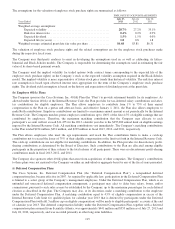

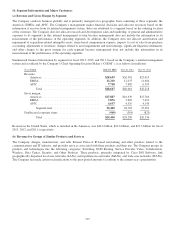

(c) Summary of Share-Based Compensation Expense

Share-based compensation expense consists primarily of expenses for stock options, stock purchase rights, restricted stock,

and restricted stock units granted to employees. The following table summarizes share-based compensation expense (in

millions):

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

Cost of sales—product .............................................. $40 $53 $61

Cost of sales—service ............................................... 138 156 177

Share-based compensation expense in cost of sales ........................ 178 209 238

Research and development ........................................... 286 401 481

Sales and marketing ................................................. 484 588 651

General and administrative ........................................... 175 203 250

Restructuring and other charges ....................................... (3) ——

Share-based compensation expense in operating expenses ................... 942 1,192 1,382

Total share-based compensation expense ................................ $1,120 $1,401 $1,620

Income tax benefit for share-based compensation ......................... $ 285 $ 335 $ 444

As of July 27, 2013, the total compensation cost related to unvested share-based awards not yet recognized was $2.3 billion,

which is expected to be recognized over approximately 2.5 years on a weighted-average basis.

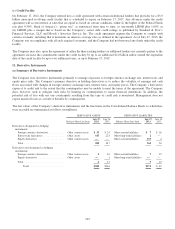

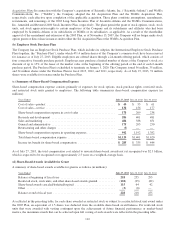

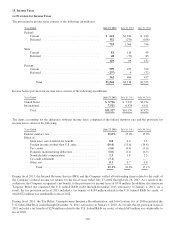

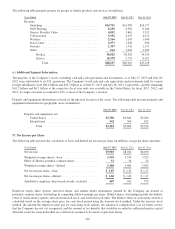

(d) Share-Based Awards Available for Grant

A summary of share-based awards available for grant is as follows (in millions):

Years Ended July 27, 2013 July 28, 2012 July 30, 2011

Balance at beginning of fiscal year ..................................... 218 255 295

Restricted stock, stock units, and other share-based awards granted ........... (102) (95) (82)

Share-based awards canceled/forfeited/expired ........................... 115 64 42

Other ............................................................ (3) (6) —

Balance at end of fiscal year .......................................... 228 218 255

As reflected in the preceding table, for each share awarded as restricted stock or subject to a restricted stock unit award under

the 2005 Plan, an equivalent of 1.5 shares was deducted from the available share-based award balance. For restricted stock

units that were awarded with vesting contingent upon the achievement of future financial performance or market-based

metrics, the maximum awards that can be achieved upon full vesting of such awards were reflected in the preceding table.

112