Cisco 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

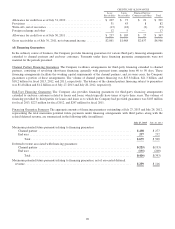

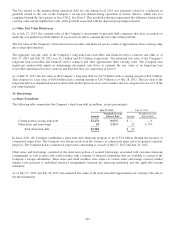

The loss related to the manufacturing operations held for sale during fiscal 2011 was primarily related to a reduction in

goodwill related to the sale of the Company’s set-top box manufacturing operations in Juarez, Mexico, which sale was

completed during the first quarter of fiscal 2012. See Note 5. This goodwill reduction represented the difference between the

carrying value and the implied fair value of the goodwill associated with the disposal group being evaluated.

(c) Other Fair Value Disclosures

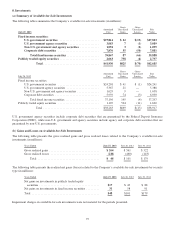

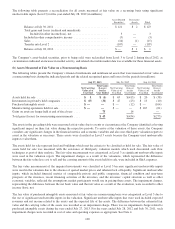

As of July 27, 2013, the carrying value of the Company’s investments in privately held companies that were accounted for

under the cost method was $242 million. It was not practicable to estimate the fair value of this portfolio.

The fair value of the Company’s short-term loan receivables and financed service contracts approximates their carrying value

due to their short duration.

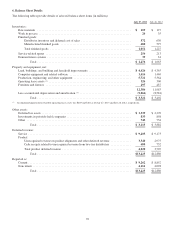

The aggregate carrying value of the Company’s long-term loan receivables and financed service contracts and other as of

July 27, 2013 and July 28, 2012 was $2.1 billion and $1.9 billion, respectively. The estimated fair value of the Company’s

long-term loan receivables and financed service contracts and other approximates their carrying value. The Company uses

significant unobservable inputs in determining discounted cash flows to estimate the fair value of its long-term loan

receivables and financed service contracts and therefore they are categorized as Level 3.

As of July 27, 2013, the fair value of the Company’s long-term debt was $17.6 billion with a carrying amount of $16.2 billion.

This compares to a fair value of $18.8 billion and a carrying amount of $16.3 billion as of July 28, 2012. The fair value of the

long-term debt was determined based on observable market prices in a less active market and was categorized as Level 2 in the

fair value hierarchy.

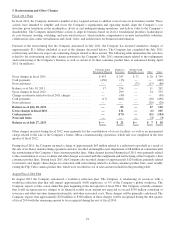

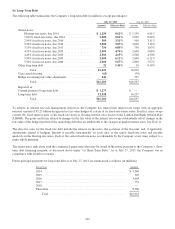

10. Borrowings

(a) Short-Term Debt

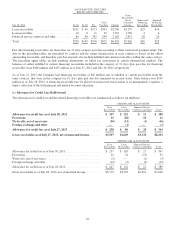

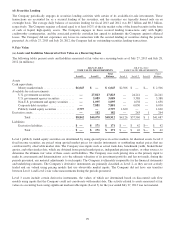

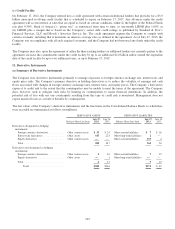

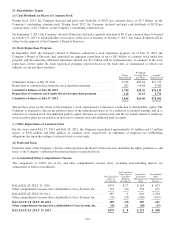

The following table summarizes the Company’s short-term debt (in millions, except percentages):

July 27, 2013 July 28, 2012

Amount

Weighted-Average

Interest Rate Amount

Weighted-Average

Interest Rate

Current portion of long-term debt ................... $3,273 0.63% $— —%

Other notes and borrowings ....................... 10 2.52% 31 6.72%

Total short-term debt ......................... $3,283 $31

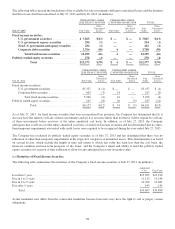

In fiscal 2011, the Company established a short-term debt financing program of up to $3.0 billion through the issuance of

commercial paper notes. The Company uses the proceeds from the issuance of commercial paper notes for general corporate

purposes. The Company had no commercial paper notes outstanding as of each of July 27, 2013 and July 28, 2012.

Other notes and borrowings consisted of the short-term portion of secured borrowings associated with customer financing

arrangements as well as notes and credit facilities with a number of financial institutions that are available to certain of the

Company’s foreign subsidiaries. These notes and credit facilities were subject to various terms and foreign currency market

interest rates pursuant to individual financial arrangements between the financing institution and the applicable foreign

subsidiary.

As of July 27, 2013 and July 28, 2012, the estimated fair value of the short-term debt approximates its carrying value due to

the short maturities.

101