Cisco 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

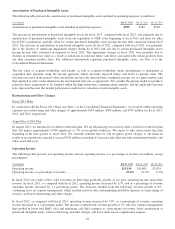

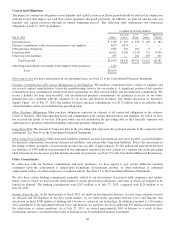

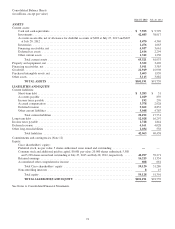

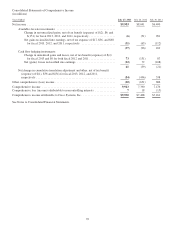

Contractual Obligations

The impact of contractual obligations on our liquidity and capital resources in future periods should be analyzed in conjunction

with the factors that impact our cash flows from operations discussed previously. In addition, we plan for and measure our

liquidity and capital resources through an annual budgeting process. The following table summarizes our contractual

obligations at July 27, 2013 (in millions):

PAYMENTS DUE BY PERIOD

July 27, 2013 Total

Less than

1 Year

1to3

Years

3to5

Years

More than

5 Years

Operating leases .................................................... $ 1,149 $ 367 $ 439 $ 160 $ 183

Purchase commitments with contract manufacturers and suppliers ............. 4,033 4,033 — — —

Other purchase obligations ............................................ 1,085 516 491 77 1

Long-term debt ..................................................... 16,021 3,260 3,510 751 8,500

Other long-term liabilities ............................................. 635 — 101 433 101

Total by period ................................................. $22,923 $8,176 $4,541 $1,421 $8,785

Other long-term liabilities (uncertainty in the timing of future payments) .......... 2,147

Total ..................................................... $25,070

Operating Leases For more information on our operating leases, see Note 12 to the Consolidated Financial Statements.

Purchase Commitments with Contract Manufacturers and Suppliers We purchase components from a variety of suppliers and

use several contract manufacturers to provide manufacturing services for our products. A significant portion of our reported

estimated purchase commitments arising from these agreements are firm, noncancelable, and unconditional commitments. We

record a liability for firm, noncancelable, and unconditional purchase commitments for quantities in excess of our future

demand forecasts consistent with the valuation of our excess and obsolete inventory. See further discussion in “Inventory

Supply Chain.” As of July 27, 2013, the liability for these purchase commitments was $172 million and is recorded in other

current liabilities and is not included in the preceding table.

Other Purchase Obligations Other purchase obligations represent an estimate of all contractual obligations in the ordinary

course of business, other than operating leases and commitments with contract manufacturers and suppliers, for which we have

not received the goods or services. Purchase orders are not included in the preceding table as they typically represent our

authorization to purchase rather than binding contractual purchase obligations.

Long-Term Debt The amount of long-term debt in the preceding table represents the principal amount of the respective debt

instruments. See Note 10 to the Consolidated Financial Statements.

Other Long-Term Liabilities Other long-term liabilities primarily include noncurrent income taxes payable, accrued liabilities

for deferred compensation, noncurrent deferred tax liabilities, and certain other long-term liabilities. Due to the uncertainty in

the timing of future payments, our noncurrent income taxes payable of approximately $1,748 million and noncurrent deferred

tax liabilities of $399 million were presented as one aggregated amount in the total column on a separate line in the preceding

table. Noncurrent income taxes payable include uncertain tax positions (see Note 15 to the Consolidated Financial Statements).

Other Commitments

In connection with our business combinations and asset purchases, we have agreed to pay certain additional amounts

contingent upon the achievement of agreed-upon technology, development, product, or other milestones or continued

employment with us of certain employees of acquired entities. See Note 12 to the Consolidated Financial Statements.

We also have certain funding commitments primarily related to our investments in privately held companies and venture

funds, some of which are based on the achievement of certain agreed-upon milestones, and some of which are required to be

funded on demand. The funding commitments were $263 million as of July 27, 2013, compared with $120 million as of

July 28, 2012.

Insieme Networks, Inc. In the third quarter of fiscal 2012, we made an investment in Insieme, an early stage company focused

on research and development in the data center market. As set forth in the agreement between Cisco and Insieme, this

investment includes $100 million of funding and a license to certain of our technology. In addition, pursuant to a November

2012 amendment to the agreement between Cisco and Insieme, we agreed to invest an additional $35 million in Insieme upon

the satisfaction of certain conditions. As of July 27, 2013, we owned approximately 84% of Insieme as a result of these

investments and have consolidated the results of Insieme in our Consolidated Financial Statements.

66