Cisco 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in

the United States requires us to make judgments, assumptions, and estimates that affect the amounts reported in the

Consolidated Financial Statements and accompanying notes. Note 2 to the Consolidated Financial Statements describes the

significant accounting policies and methods used in the preparation of the Consolidated Financial Statements. The accounting

policies described below are significantly affected by critical accounting estimates. Such accounting policies require

significant judgments, assumptions, and estimates used in the preparation of the Consolidated Financial Statements, and actual

results could differ materially from the amounts reported based on these policies.

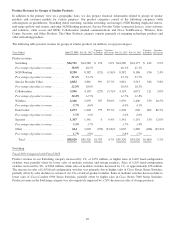

Revenue Recognition

Revenue is recognized when all of the following criteria have been met:

•Persuasive evidence of an arrangement exists. Contracts, Internet commerce agreements, and customer purchase

orders are generally used to determine the existence of an arrangement.

•Delivery has occurred. Shipping documents and customer acceptance, when applicable, are used to verify delivery.

•The fee is fixed or determinable. We assess whether the fee is fixed or determinable based on the payment terms

associated with the transaction and whether the sales price is subject to refund or adjustment.

•Collectibility is reasonably assured. We assess collectibility based primarily on the creditworthiness of the customer

as determined by credit checks and analysis, as well as the customer’s payment history.

In instances where final acceptance of the product, system, or solution is specified by the customer, revenue is deferred until

all acceptance criteria have been met. When a sale involves multiple deliverables, such as sales of products that include

services, the multiple deliverables are evaluated to determine the unit of accounting, and the entire fee from the arrangement is

allocated to each unit of accounting based on the relative selling price. Revenue is recognized when the revenue recognition

criteria for each unit of accounting are met.

The amount of product and service revenue recognized in a given period is affected by our judgment as to whether an

arrangement includes multiple deliverables and, if so, our valuation of the units of accounting for multiple deliverables.

According to the accounting guidance prescribed in Accounting Standards Codification (ASC) 605, Revenue Recognition,we

use vendor-specific objective evidence of selling price (VSOE) for each of those units, when available. We determine VSOE

based on our normal pricing and discounting practices for the specific product or service when sold separately. In determining

VSOE, we require that a substantial majority of the historical standalone transactions have the selling prices for a product or

service fall within a reasonably narrow pricing range, generally evidenced by approximately 80% of such historical standalone

transactions falling within plus or minus 15% of the median rates. When VSOE does not exist, we apply the selling price

hierarchy to applicable multiple-deliverable arrangements. Under the selling price hierarchy, third-party evidence of selling

price (TPE) will be considered if VSOE does not exist, and estimated selling price (ESP) will be used if neither VSOE nor

TPE is available. Generally, we are not able to determine TPE because our go-to-market strategy differs from that of others in

our markets, and the extent of our proprietary technology varies among comparable products or services from those of our

peers. In determining ESP, we apply significant judgment as we weigh a variety of factors, based on the facts and

circumstances of the arrangement. We typically arrive at an ESP for a product or service that is not sold separately by

considering company-specific factors such as geographies, competitive landscape, internal costs, profitability objectives,

pricing practices used to establish bundled pricing, and existing portfolio pricing and discounting.

Some of our sales arrangements have multiple deliverables containing software and related software support components.

Such sales arrangements are subject to the accounting guidance in ASC 985-605, Software-Revenue Recognition.

As our business and offerings evolve over time, our pricing practices may be required to be modified accordingly, which could

result in changes in selling prices, including both VSOE and ESP, in subsequent periods. There were no material impacts

during fiscal 2013, nor do we currently expect a material impact in the next 12 months on our revenue recognition due to any

changes in our VSOE, TPE, or ESP.

Revenue deferrals relate to the timing of revenue recognition for specific transactions based on financing arrangements,

service, support, and other factors. Financing arrangements may include sales-type, direct-financing, and operating leases,

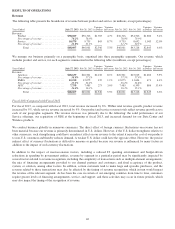

loans, and guarantees of third-party financing. Our deferred revenue for products was $4.0 billion and $3.7 billion as of

July 27, 2013 and July 28, 2012, respectively. Technical support services revenue is deferred and recognized ratably over the

period during which the services are to be performed, which typically is from one to three years. Advanced services revenue is

recognized upon delivery or completion of performance. Our deferred revenue for services was $9.4 billion and $9.2 billion as

of July 27, 2013 and July 28, 2012, respectively.

40