Cisco 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13. Shareholders’ Equity

(a) Cash Dividends on Shares of Common Stock

During fiscal 2013, the Company declared and paid cash dividends of $0.62 per common share, or $3.3 billion, on the

Company’s outstanding common stock. During fiscal 2012, the Company declared and paid cash dividends of $0.28 per

common share, or $1.5 billion, on the Company’s outstanding common stock.

On September 3, 2013, the Company’s Board of Directors declared a quarterly dividend of $0.17 per common share to be paid

on October 23, 2013 to all shareholders of record as of the close of business on October 3, 2013. Any future dividends will be

subject to the approval of the Company’s Board of Directors.

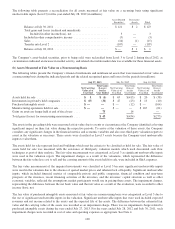

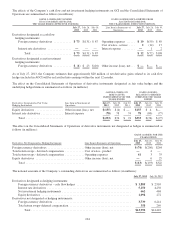

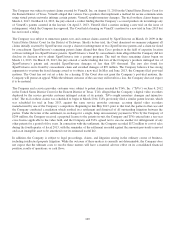

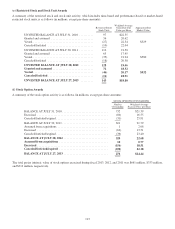

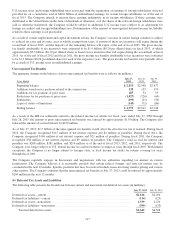

(b) Stock Repurchase Program

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 27, 2013, the

Company’s Board of Directors had authorized an aggregate repurchase of up to $82 billion of common stock under this

program, and the remaining authorized repurchase amount was $3.1 billion with no termination date. A summary of the stock

repurchase activity under the stock repurchase program, reported based on the trade date, is summarized as follows (in

millions, except per-share amounts):

Shares

Repurchased

Weighted-

Average Price

per Share

Amount

Repurchased

Cumulative balance at July 30, 2011 ......................................... 3,478 $20.64 $71,773

Repurchase of common stock under the stock repurchase program ................. 262 16.64 4,360

Cumulative balance at July 28, 2012 ....................................... 3,740 $20.36 $76,133

Repurchase of common stock under the stock repurchase program ............. 128 21.63 2,773

Cumulative balance at July 27, 2013 ....................................... 3,868 $20.40 $78,906

The purchase price for the shares of the Company’s stock repurchased is reflected as a reduction to shareholders’ equity. The

Company is required to allocate the purchase price of the repurchased shares as (i) a reduction to retained earnings and (ii) a

reduction of common stock and additional paid-in capital. Issuance of common stock and the tax benefit related to employee

stock incentive plans are recorded as an increase to common stock and additional paid-in capital.

(c) Other Repurchases of Common Stock

For the years ended July 27, 2013 and July 28, 2012, the Company repurchased approximately 16 million and 12 million

shares, or $330 million and $200 million, of common stock, respectively, in settlement of employee tax withholding

obligations due upon the vesting of restricted stock or stock units.

(d) Preferred Stock

Under the terms of the Company’s Articles of Incorporation, the Board of Directors may determine the rights, preferences, and

terms of the Company’s authorized but unissued shares of preferred stock.

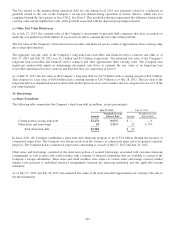

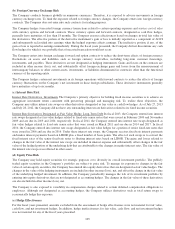

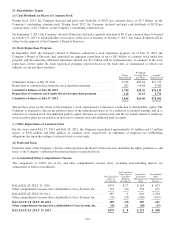

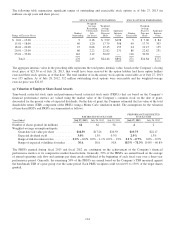

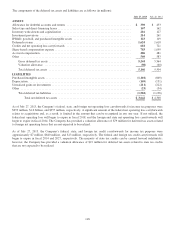

(e) Accumulated Other Comprehensive Income

The components of AOCI, net of tax, and other comprehensive income (loss), excluding noncontrolling interest, are

summarized as follows (in millions):

Net Unrealized

Gains on

Investments

Net Unrealized

Gains (Losses)

Cash Flow

Hedging

Instruments

Cumulative

Translation

Adjustment and

Other

Accumulated

Other

Comprehensive

Income

BALANCE AT JULY 31, 2010 .................................... $333 $ 27 $ 263 $ 623

Other comprehensive income (loss) attributable to Cisco Systems, Inc. .... 154 (21) 538 671

BALANCE AT JULY 30, 2011 .................................... 487 6 801 1,294

Other comprehensive income (loss) attributable to Cisco Systems, Inc. .... (78) (59) (496) (633)

BALANCE AT JULY 28, 2012 ................................... 409 (53) 305 661

Other comprehensive income (loss) attributable to Cisco Systems, Inc. .... (30) 61 (84) (53)

BALANCE AT JULY 27, 2013 ................................... $379 $ 8 $ 221 $ 608

110