Cisco 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

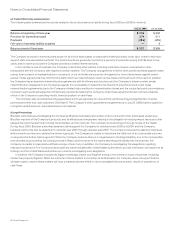

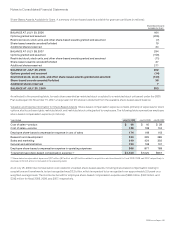

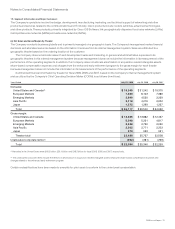

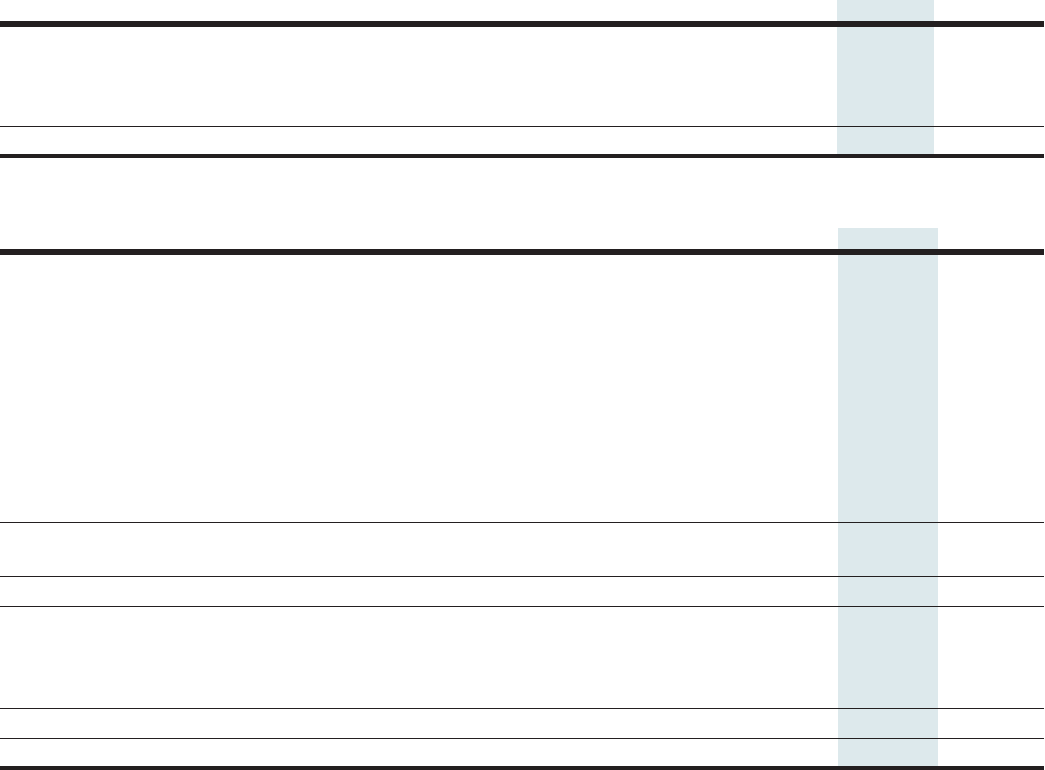

(c) Deferred Tax Assets and Liabilities

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 25, 2009 July 26, 2008

Deferred tax assets — current $ 2,320 $ 2,075

Deferred tax liabilities — current (12) (9)

Deferred tax assets — noncurrent 2,122 1,770

Deferred tax liabilities — noncurrent (57) (80)

Total net deferred tax assets $ 4,373 $ 3,756

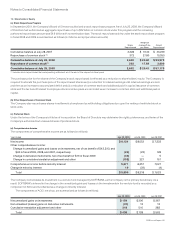

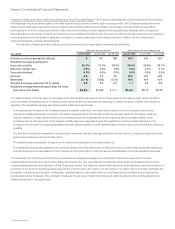

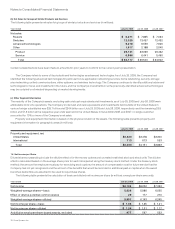

The components of the deferred tax assets and liabilities are as follows (in millions):

July 25, 2009 July 26, 2008

ASSETS

Allowance for doubtful accounts and returns $ 300 $ 256

Sales-type and direct-financing leases 226 93

Inventory write-downs and capitalization 238 239

Investment provisions 333 420

In-process R&D, goodwill, and purchased intangible assets 222 343

Deferred revenue 1,475 1,304

Credits and net operating loss carryforwards 817 841

Share-based compensation expense 809 603

Accrued compensation 405 226

Other 600 592

Gross deferred tax assets 5,425 4,917

Valuation allowance (66) (118)

Total deferred tax assets 5,359 4,799

LIABILITIES

Purchased intangible assets (639) (709)

Depreciation (288) (195)

Other (59) (139)

Total deferred tax liabilities (986) (1,043)

Total net deferred tax assets $ 4,373 $ 3,756

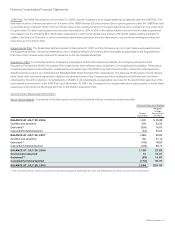

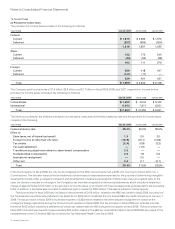

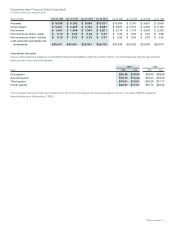

As of July 25, 2009, the Company’s federal, state, and foreign net operating loss carryforwards for income tax purposes were $421 million,

$1.9 billion, and $229 million, respectively. If not utilized, the federal net operating loss carryforwards will begin to expire in fiscal 2018, the

state net operating loss carryforwards will begin to expire in fiscal 2010, and the foreign net operating loss carryforwards will begin to

expire in fiscal 2011. As of July 25, 2009, the Company’s federal and state tax credit carryforwards for income tax purposes were

approximately $10 million and $618 million, respectively. If not utilized, the federal and state tax credit carryforwards will begin to expire in

fiscal 2010.

74 Cisco Systems, Inc.