Cisco 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

(d) Allowance for Doubtful Accounts The allowance for doubtful accounts is based on the Company’s assessment of the collectibility of

customer accounts. The Company regularly reviews the allowance by considering factors such as historical experience, credit quality, age

of the accounts receivable balances, and economic conditions that may affect a customer’s ability to pay.

(e) Financing Receivables and Guarantees The Company provides financing arrangements, including leases, financed service contracts,

and loans, for certain qualified end-user customers to build, maintain, and upgrade their networks. Lease receivables primarily represent

sales-type and direct-financing leases. Leases and loans typically have a three-year term and are usually collateralized by a security

interest in the underlying assets. Financed service contracts also typically have terms of one to three years and primarily relate to technical

support services. The Company maintains an allowance for uncollectible financing receivables based on a variety of factors, including the

risk rating of the portfolio, macroeconomic conditions, historical experience, and other market factors.

In addition, the Company facilitates third-party financing arrangements for channel partners, consisting of revolving short-term

financing, generally with payment terms ranging from 60 to 90 days. In certain instances, these financing arrangements result in a transfer

of the Company’s receivables to the third party. The receivables are derecognized upon transfer, as these transfers qualify as true sales,

and the Company receives a payment for the receivables from the third party based on the Company’s standard payment terms. These

financing arrangements facilitate the working capital requirements of the channel partners and, in some cases, the Company guarantees a

portion of these arrangements. The Company also provides financing guarantees for third-party financing arrangements extended to

end-user customers related to leases and loans, which typically have terms of up to three years. The Company could be called upon to

make payments under these guarantees in the event of nonpayment by the channel partners or end-user customers. Deferred revenue is

recorded in accordance with revenue recognition policies or for the fair value of the financing guarantees.

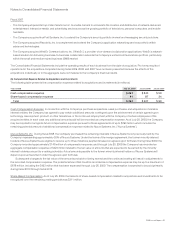

(f) Depreciation and Amortization Property and equipment are stated at cost, less accumulated depreciation and amortization.

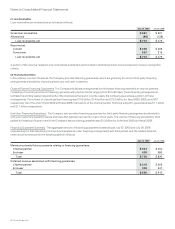

Depreciation and amortization are computed using the straight-line method, generally over the following periods:

Period

Buildings 25 years

Building improvements 10 years

Furniture and fixtures 5 years

Production, engineering, and other equipment Up to 5 years

Computer equipment and related software 30 to 36 months

Operating lease assets Based on lease term—

generally up to 3 years

Depreciation and amortization of leasehold improvements Shorter of remaining

lease term or 5 years

(g) Goodwill and Purchased Intangible Assets Goodwill is tested for impairment on an annual basis in the fourth fiscal quarter and between

annual tests in certain circumstances, and written down when impaired. Based on the impairment tests performed, there was no

impairment of goodwill in fiscal 2009, 2008, or 2007. Purchased intangible assets are amortized over their useful lives unless these lives are

determined to be indefinite. Purchased intangible assets are carried at cost, less accumulated amortization. Amortization is computed over

the estimated useful lives of the respective assets, generally two to seven years.

(h) Impairment of Long-Lived Assets Long-lived assets and certain identifiable intangible assets to be held and used are reviewed for

impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable.

Determination of recoverability of long-lived assets is based on an estimate of the undiscounted future cash flows resulting from the use of

the asset and its eventual disposition. Measurement of an impairment loss for long-lived assets and certain identifiable intangible assets

that management expects to hold and use is based on the fair value of the asset. Long-lived assets and certain identifiable intangible

assets to be disposed of are reported at the lower of carrying amount or fair value less costs to sell.

(i) Derivative Instruments The Company recognizes derivative instruments as either assets or liabilities and measures those instruments at

fair value. The accounting for changes in the fair value of a derivative depends on the intended use of the derivative and the resulting

designation. For a derivative instrument designated as a fair value hedge, the gain or loss is recognized in earnings in the period of change

together with the offsetting loss or gain on the hedged item attributed to the risk being hedged. For a derivative instrument designated as a

cash flow hedge, the effective portion of the derivative’s gain or loss is initially reported as a component of AOCI and subsequently

reclassified into earnings when the hedged exposure affects earnings. The ineffective portion of the gain or loss is reported in earnings

immediately. For derivative instruments that are not designated as accounting hedges, changes in fair value are recognized in earnings in

the period of change.

44 Cisco Systems, Inc.