Cisco 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

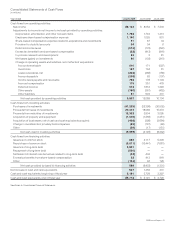

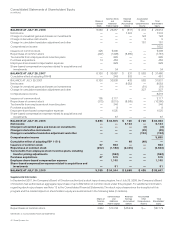

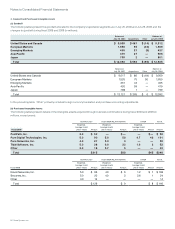

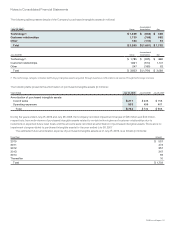

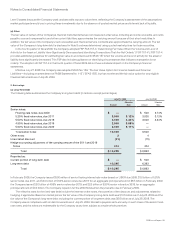

The following tables present details of the Company’s purchased intangible assets (in millions):

Gross

Accumulated

Amortization NetJuly 25, 2009

Technology(1) $ 1,469 $ (803) $ 666

Customer relationships 1,730 (768) 962

Other 184 (110) 74

Total $ 3,383 $ (1,681) $ 1,702

July 26, 2008 Gross

Accumulated

Amortization Net

Technology(1) $ 1,785 $ (905) $ 880

Customer relationships 1,821 (674) 1,147

Other 247 (185) 62

Total $ 3,853 $ (1,764) $ 2,089

(1) The technology category includes technology intangible assets acquired through business combinations as well as through technology licenses.

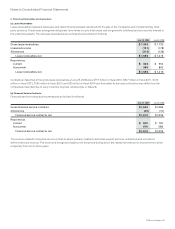

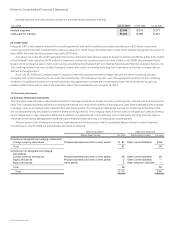

The following table presents the amortization of purchased intangible assets (in millions):

Years Ended July 25, 2009 July 26, 2008 July 28, 2007

Amortization of purchased intangible assets:

Cost of sales $ 211 $ 233 $ 156

Operating expenses 533 499 407

Total $ 744 $ 732 $ 563

During the years ended July 25, 2009 and July 26, 2008, the Company recorded impairment charges of $95 million and $33 million,

respectively, from write-downs of purchased intangible assets related to certain technologies and customer relationships due to

reductions in expected future cash flows, and the amounts were recorded as amortization of purchased intangible assets. There were no

impairment charges related to purchased intangible assets for the year ended July 28, 2007.

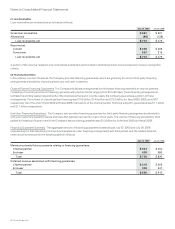

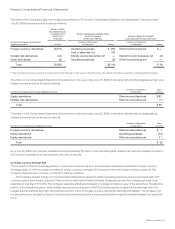

The estimated future amortization expense of purchased intangible assets as of July 25, 2009, is as follows (in millions):

Fiscal Year Amount

2010 $ 557

2011 472

2012 357

2013 247

2014 59

Thereafter 10

Total $ 1,702

2009 Annual Report 51